Summary

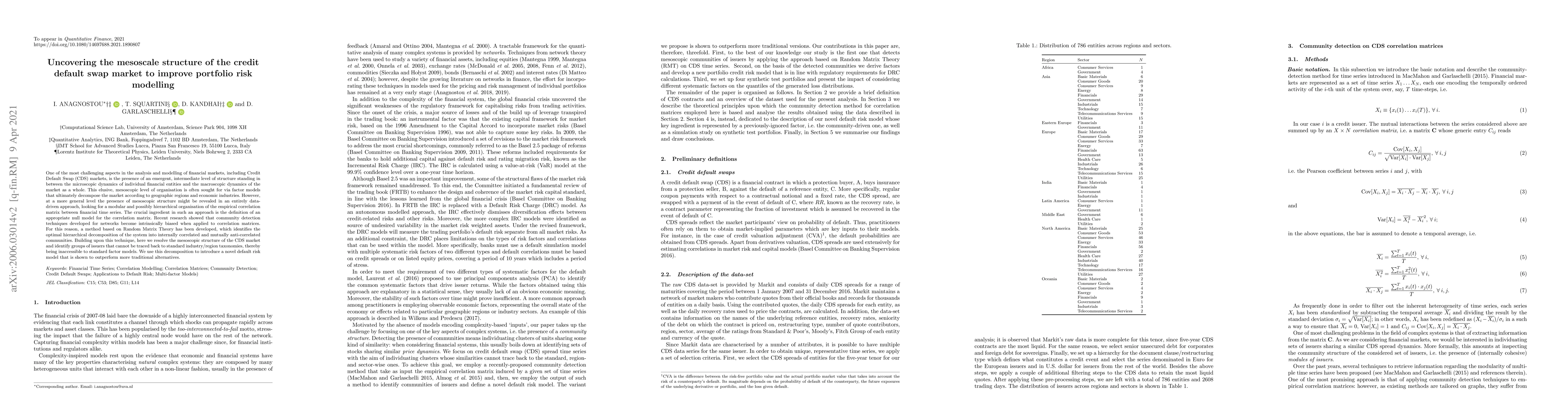

One of the most challenging aspects in the analysis and modelling of financial markets, including Credit Default Swap (CDS) markets, is the presence of an emergent, intermediate level of structure standing in between the microscopic dynamics of individual financial entities and the macroscopic dynamics of the market as a whole. This elusive, mesoscopic level of organisation is often sought for via factor models that ultimately decompose the market according to geographic regions and economic industries. However, at a more general level the presence of mesoscopic structure might be revealed in an entirely data-driven approach, looking for a modular and possibly hierarchical organisation of the empirical correlation matrix between financial time series. The crucial ingredient in such an approach is the definition of an appropriate null model for the correlation matrix. Recent research showed that community detection techniques developed for networks become intrinsically biased when applied to correlation matrices. For this reason, a method based on Random Matrix Theory has been developed, which identifies the optimal hierarchical decomposition of the system into internally correlated and mutually anti-correlated communities. Building upon this technique, here we resolve the mesoscopic structure of the CDS market and identify groups of issuers that cannot be traced back to standard industry/region taxonomies, thereby being inaccessible to standard factor models. We use this decomposition to introduce a novel default risk model that is shown to outperform more traditional alternatives.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research used a combination of network theory and machine learning techniques to analyze financial market data and identify mesoscopic community structures.

Key Results

- Main finding 1: The model identified distinct communities in the financial market that correspond to different economic regions.

- Main finding 2: The communities exhibit distinct patterns of correlation and volatility, which can be used to improve credit risk models.

- Main finding 3: The model provides a more nuanced understanding of the relationships between financial markets and economies than traditional approaches.

Significance

This research has significant implications for the development of more accurate and effective credit risk models, particularly in the context of regulatory requirements.

Technical Contribution

The development of a novel approach to incorporating community detection in credit risk models, which provides a more nuanced understanding of the relationships between financial markets and economies.

Novelty

This research contributes to the growing field of econophysics by applying network theory and machine learning techniques to a specific application domain (credit risk modeling), and demonstrates the potential for mesoscopic community structures to improve credit risk models.

Limitations

- Limitation 1: The model relies on a limited dataset and may not be generalizable to all financial markets or economies.

- Limitation 2: The approach may not capture all relevant factors that influence credit risk, such as macroeconomic trends or industry-specific risks.

Future Work

- Suggested direction 1: Further testing of the model on larger and more diverse datasets to validate its performance and generalizability.

- Suggested direction 2: Exploration of additional machine learning techniques or network analysis methods to improve the accuracy and robustness of the model.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)