Authors

Summary

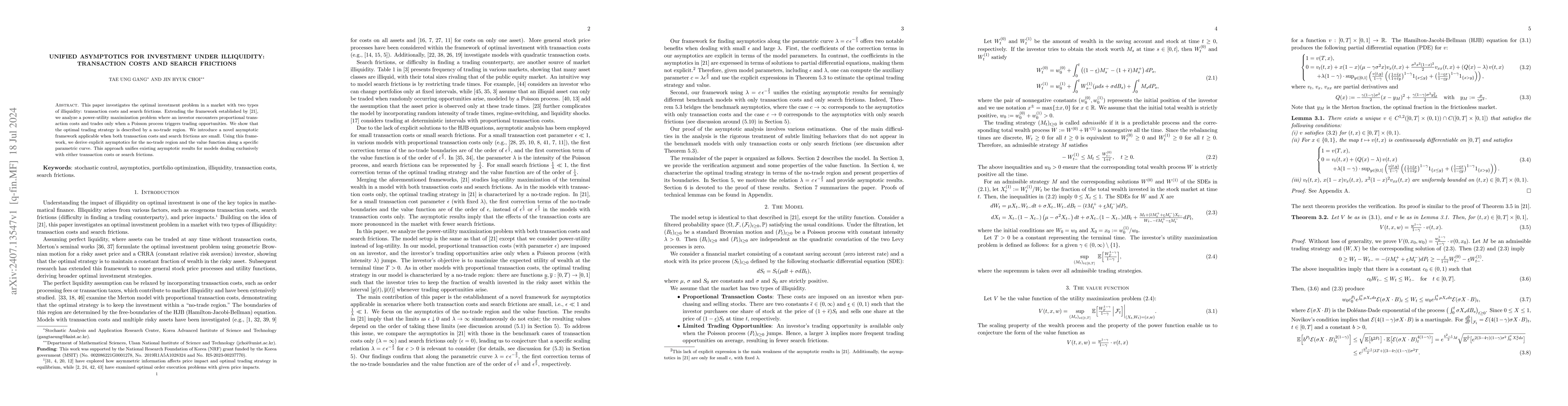

This paper investigates the optimal investment problem in a market with two types of illiquidity: transaction costs and search frictions. Extending the framework established by arXiv:2101.09936, we analyze a power-utility maximization problem where an investor encounters proportional transaction costs and trades only when a Poisson process triggers trading opportunities. We show that the optimal trading strategy is described by a no-trade region. We introduce a novel asymptotic framework applicable when both transaction costs and search frictions are small. Using this framework, we derive explicit asymptotics for the no-trade region and the value function along a specific parametric curve. This approach unifies existing asymptotic results for models dealing exclusively with either transaction costs or search frictions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)