Summary

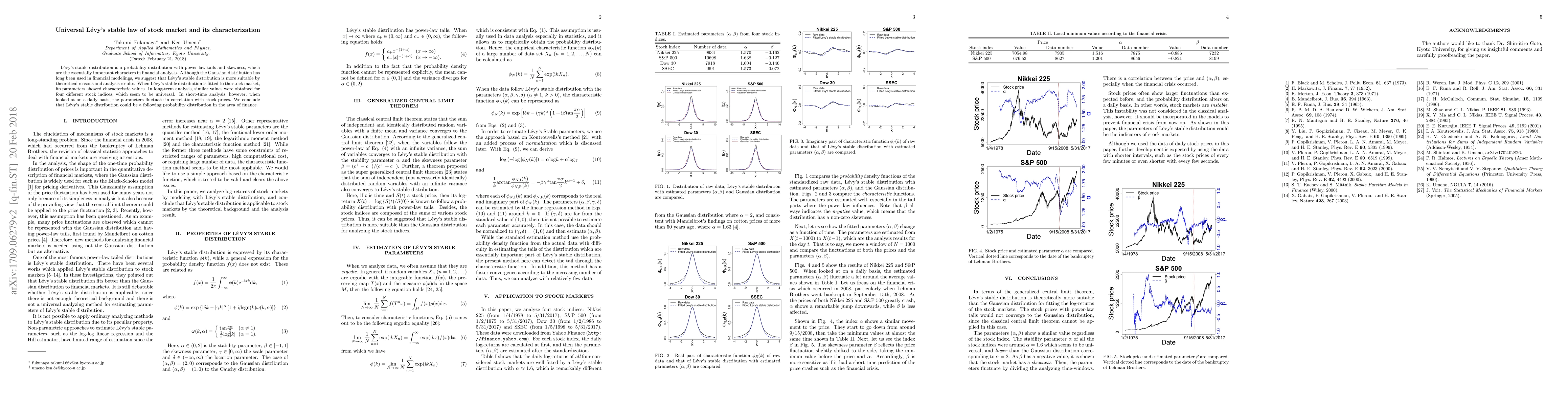

Price fluctuations in financial markets can be characterized by L\'evy's stable distribution, which is supported by the generalized central limit system. When the stable parameters were estimated from four different stock markets in long term, they similarly indicated an unique value. On the other hand, when analyzed in short term, parameters and the stock prices fluctuated with correlation, which shows that the stock markets are instable.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)