Summary

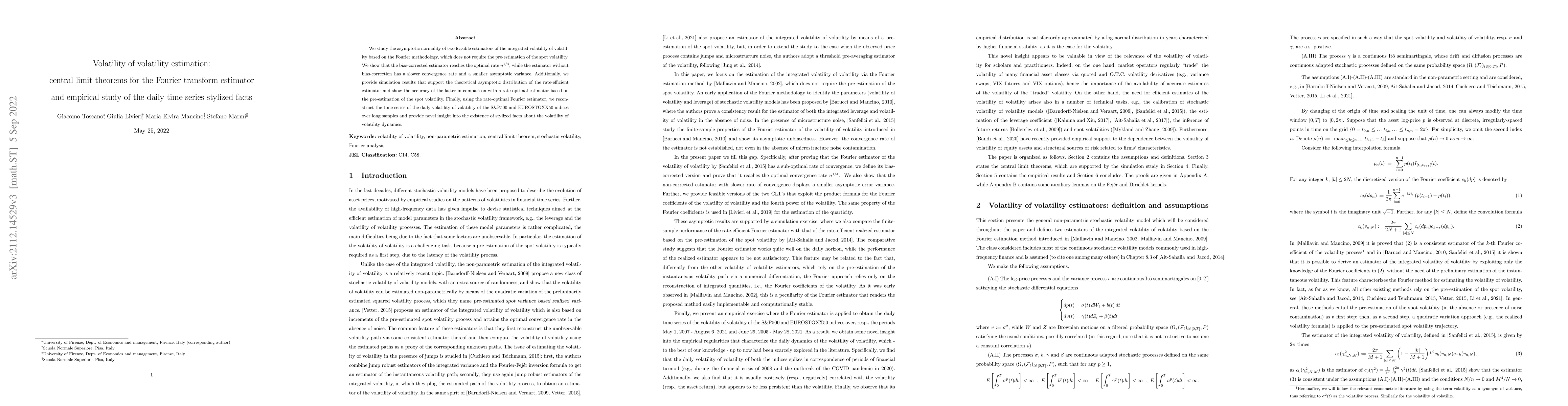

We study the asymptotic normality of two feasible estimators of the integrated volatility of volatility based on the Fourier methodology, which does not require the pre-estimation of the spot volatility. We show that the bias-corrected estimator reaches the optimal rate $n^{1/4}$, while the estimator without bias-correction has a slower convergence rate and a smaller asymptotic variance. Additionally, we provide simulation results that support the theoretical asymptotic distribution of the rate-efficient estimator and show the accuracy of the latter in comparison with a rate-optimal estimator based on the pre-estimation of the spot volatility. Finally, using the rate-optimal Fourier estimator, we reconstruct the time series of the daily volatility of volatility of the S\&P500 and EUROSTOXX50 indices over long samples and provide novel insight into the existence of stylized facts about the volatility of volatility dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)