Summary

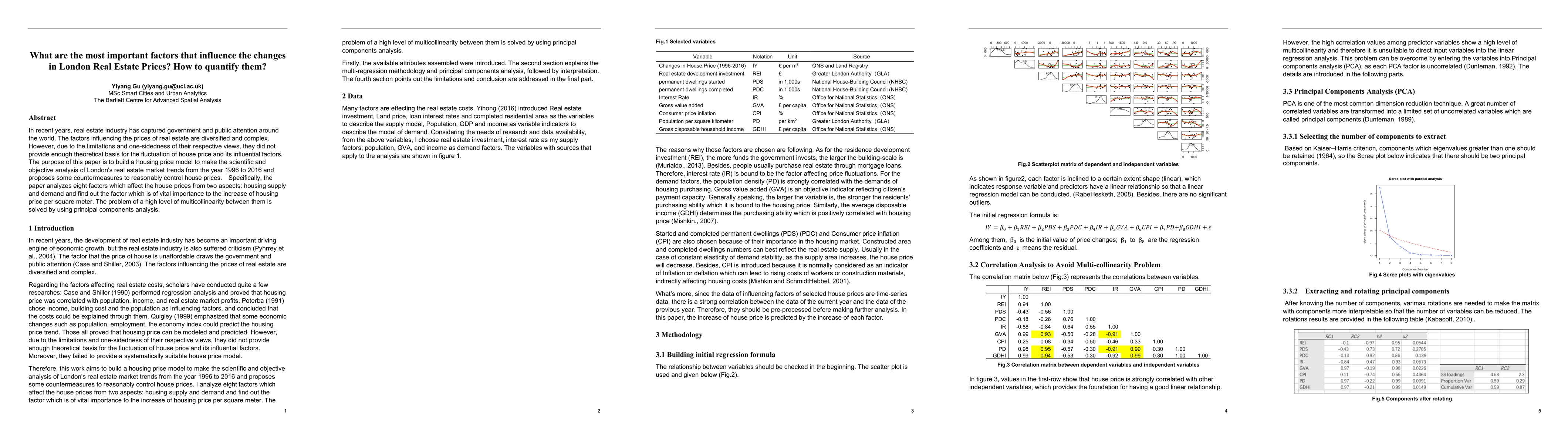

In recent years, real estate industry has captured government and public attention around the world. The factors influencing the prices of real estate are diversified and complex. However, due to the limitations and one-sidedness of their respective views, they did not provide enough theoretical basis for the fluctuation of house price and its influential factors. The purpose of this paper is to build a housing price model to make the scientific and objective analysis of London's real estate market trends from the year 1996 to 2016 and proposes some countermeasures to reasonably control house prices. Specifically, the paper analyzes eight factors which affect the house prices from two aspects: housing supply and demand and find out the factor which is of vital importance to the increase of housing price per square meter. The problem of a high level of multicollinearity between them is solved by using principal components analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHedonic Models of Real Estate Prices: GAM and Environmental Factors

W. Brent Lindquist, Svetlozar T. Rachev, Jason R. Bailey et al.

Using Machine Learning to Evaluate Real Estate Prices Using Location Big Data

Heman Shakeri, Walter Coleman, Ben Johann et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)