Authors

Summary

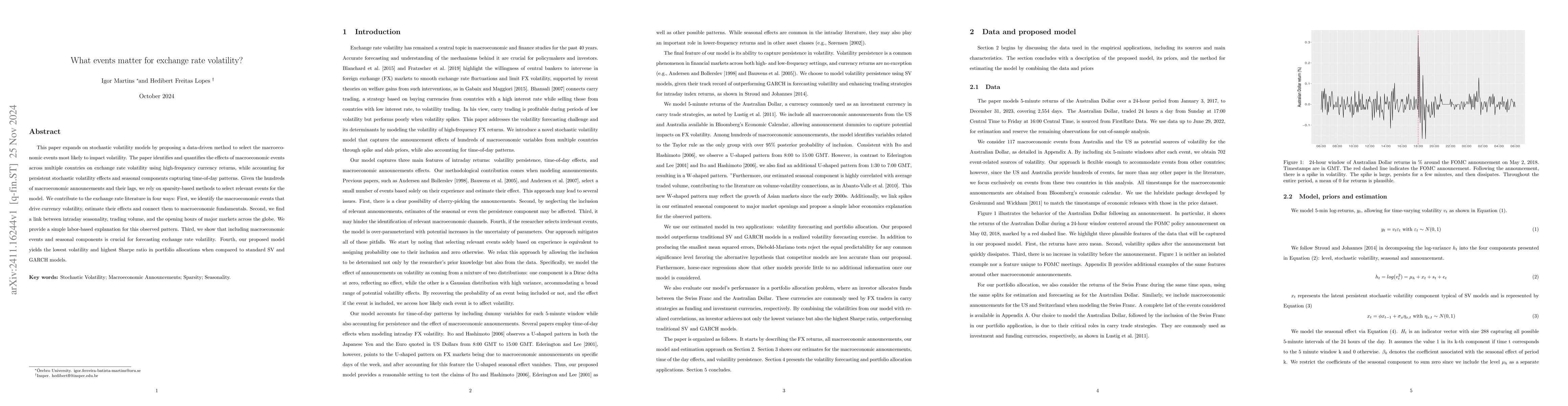

This paper expands on stochastic volatility models by proposing a data-driven method to select the macroeconomic events most likely to impact volatility. The paper identifies and quantifies the effects of macroeconomic events across multiple countries on exchange rate volatility using high-frequency currency returns, while accounting for persistent stochastic volatility effects and seasonal components capturing time-of-day patterns. Given the hundreds of macroeconomic announcements and their lags, we rely on sparsity-based methods to select relevant events for the model. We contribute to the exchange rate literature in four ways: First, we identify the macroeconomic events that drive currency volatility, estimate their effects and connect them to macroeconomic fundamentals. Second, we find a link between intraday seasonality, trading volume, and the opening hours of major markets across the globe. We provide a simple labor-based explanation for this observed pattern. Third, we show that including macroeconomic events and seasonal components is crucial for forecasting exchange rate volatility. Fourth, our proposed model yields the lowest volatility and highest Sharpe ratio in portfolio allocations when compared to standard SV and GARCH models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExport proceeds repatriation policies: A shield against exchange rate volatility in emerging markets?

Sondang Marsinta Uli Panggabean, Mahjus Ekananda, Beta Yulianita Gitaharie et al.

Impact of COVID-19 on Exchange rate volatility of Bangladesh: Evidence through GARCH model

Rizwanul Karim

Intraday foreign exchange rate volatility forecasting: univariate and multilevel functional GARCH models

Han Lin Shang, Yuqian Zhao, Fearghal Kearney

No citations found for this paper.

Comments (0)