Authors

Summary

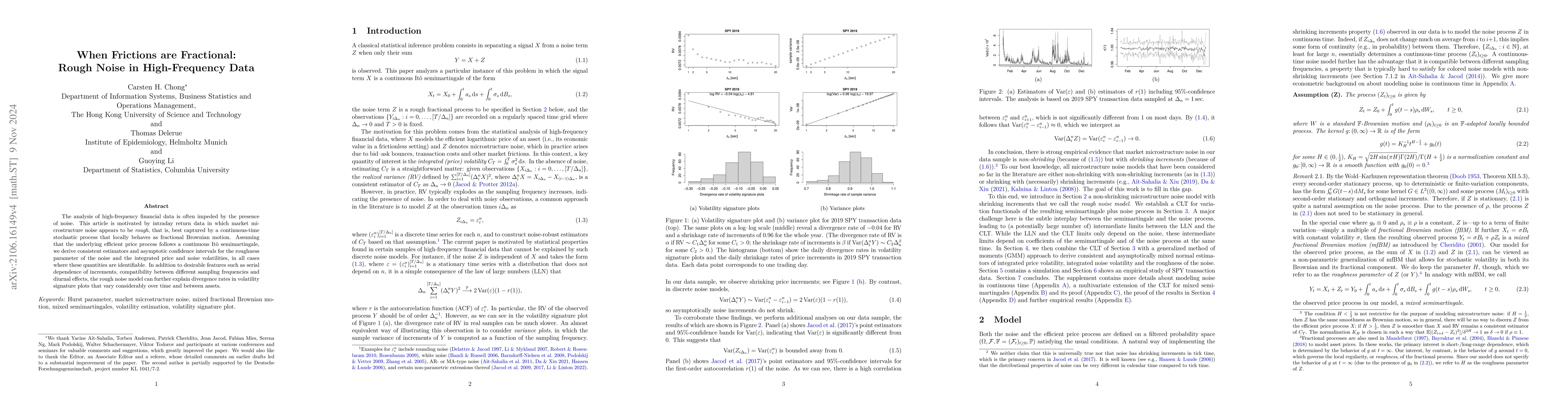

The analysis of high-frequency financial data is often impeded by the presence of noise. This article is motivated by intraday transactions data in which market microstructure noise appears to be rough, that is, best captured by a continuous-time stochastic process that locally behaves as fractional Brownian motion. Assuming that the underlying efficient price process follows a continuous It\^o semimartingale, we derive consistent estimators and asymptotic confidence intervals for the roughness parameter of the noise and the integrated price and noise volatilities, in all cases where these quantities are identifiable. In addition to desirable features such as serial dependence of increments, compatibility between different sampling frequencies and diurnal effects, the rough noise model can further explain divergence rates in volatility signature plots that vary considerably over time and between assets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStochastic fractional diffusion equations with Gaussian noise rough in space

Jian Song, Yuhui Guo, Xiaoming Song

Pathwise Optimal Control and Rough Fractional Hamilton-Jacobi-Bellman Equations for Rough-Fractional Dynamics

Thomas Cass, Dan Crisan, Andrea Iannucci

| Title | Authors | Year | Actions |

|---|

Comments (0)