Authors

Summary

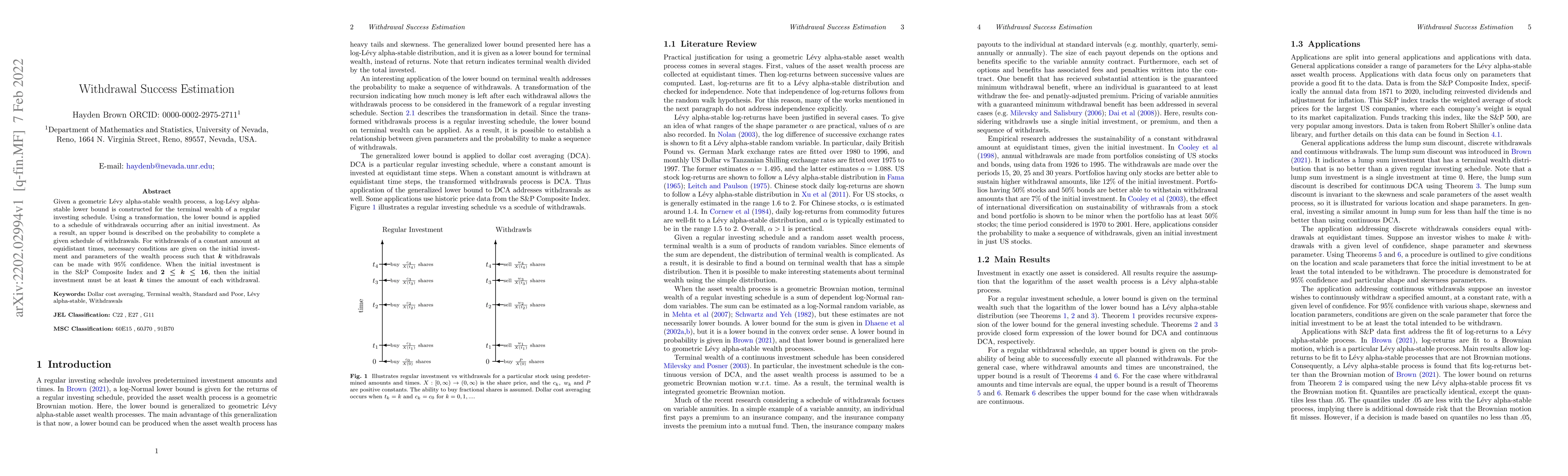

Given a geometric Levy alpha-stable wealth process, a log-Levy alpha-stable lower bound is constructed for the terminal wealth of a regular investing schedule. Using a transformation, the lower bound is applied to a schedule of withdrawals occurring after an initial investment. As a result, an upper bound is described on the probability to complete a given schedule of withdrawals. For withdrawals of a constant amount at equidistant times, necessary conditions are given on the initial investment and parameters of the wealth process such that $k$ withdrawals can be made with 95% confidence. When the initial investment is in the S&P Composite Index and $2\leq k\leq 16$, then the initial investment must be at least $k$ times the amount of each withdrawal.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTight Success Probabilities for Quantum Period Finding and Phase Estimation

Malik Magdon-Ismail, Khai Dong

No citations found for this paper.

Comments (0)