Authors

Summary

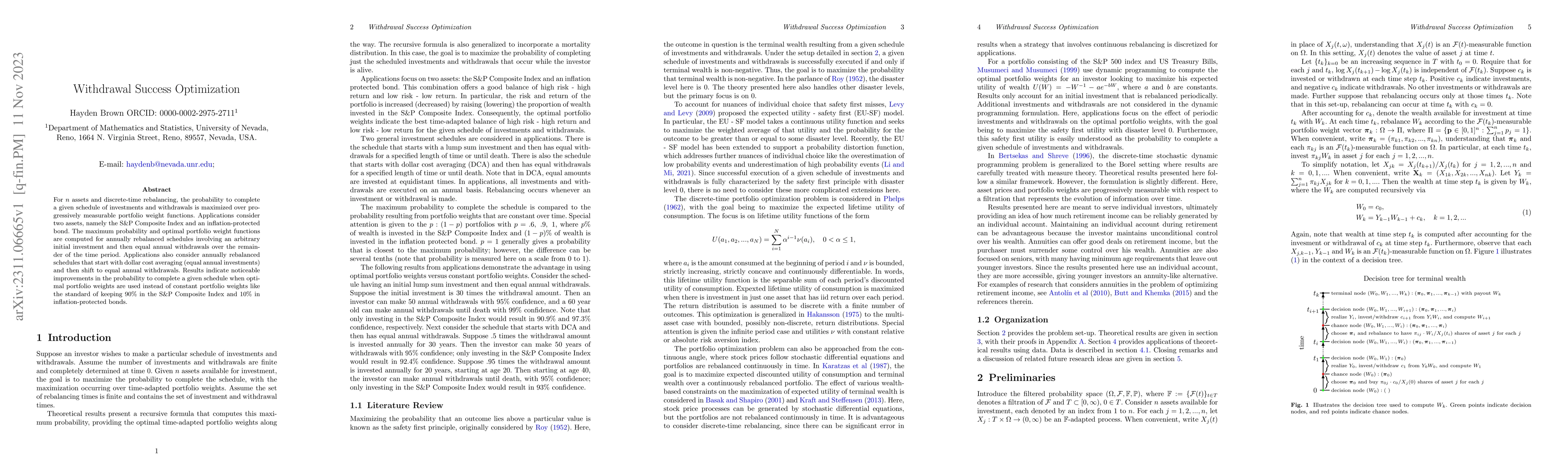

For $n$ assets and discrete-time rebalancing, the probability to complete a given schedule of investments and withdrawals is maximized over progressively measurable portfolio weight functions. Applications consider two assets, namely the S&P Composite Index and an inflation-protected bond. The maximum probability and optimal portfolio weight functions are computed for annually rebalanced schedules involving an arbitrary initial investment and then equal annual withdrawals over the remainder of the time period. Applications also consider annually rebalanced schedules that start with dollar cost averaging (equal annual investments) and then shift to equal annual withdrawals. Results indicate noticeable improvements in the probability to complete a given schedule when optimal portfolio weights are used instead of constant portfolio weights like the standard of keeping 90% in the S&P Composite Index and 10% in inflation-protected bonds.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)