Authors

Summary

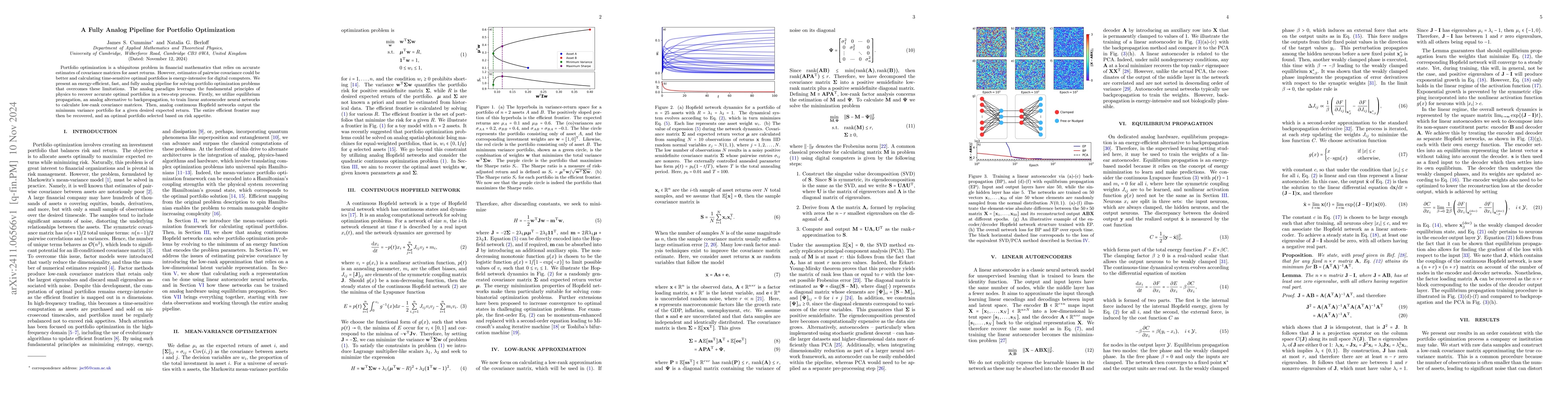

Portfolio optimization is a ubiquitous problem in financial mathematics that relies on accurate estimates of covariance matrices for asset returns. However, estimates of pairwise covariance could be better and calculating time-sensitive optimal portfolios is energy-intensive for digital computers. We present an energy-efficient, fast, and fully analog pipeline for solving portfolio optimization problems that overcomes these limitations. The analog paradigm leverages the fundamental principles of physics to recover accurate optimal portfolios in a two-step process. Firstly, we utilize equilibrium propagation, an analog alternative to backpropagation, to train linear autoencoder neural networks to calculate low-rank covariance matrices. Then, analog continuous Hopfield networks output the minimum variance portfolio for a given desired expected return. The entire efficient frontier may then be recovered, and an optimal portfolio selected based on risk appetite.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDecomposition Pipeline for Large-Scale Portfolio Optimization with Applications to Near-Term Quantum Computing

Yue Sun, Ruslan Shaydulin, Marco Pistoia et al.

A Quantum Online Portfolio Optimization Algorithm

Patrick Rebentrost, Debbie Lim

No citations found for this paper.

Comments (0)