Summary

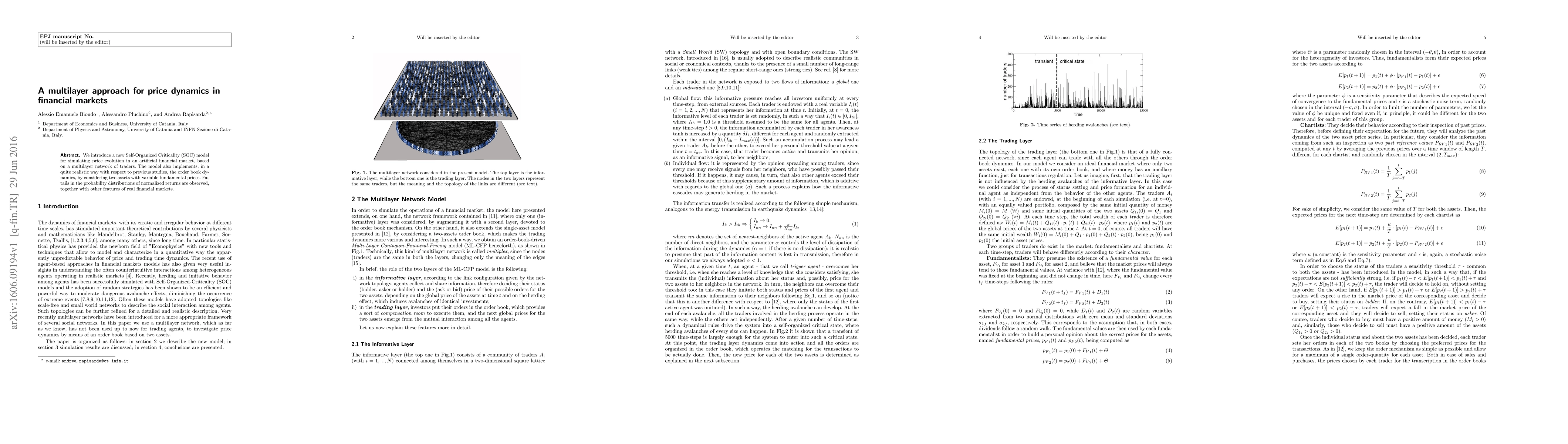

We introduce a new Self-Organized Criticality (SOC) model for simulating price evolution in an artificial financial market, based on a multilayer network of traders. The model also implements, in a quite realistic way with respect to previous studies, the order book dy- namics, by considering two assets with variable fundamental prices. Fat tails in the probability distributions of normalized returns are observed, together with other features of real financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMamba Meets Financial Markets: A Graph-Mamba Approach for Stock Price Prediction

Xiaohong Chen, Ehsan Hoseinzade, Ali Mehrabian et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)