Authors

Summary

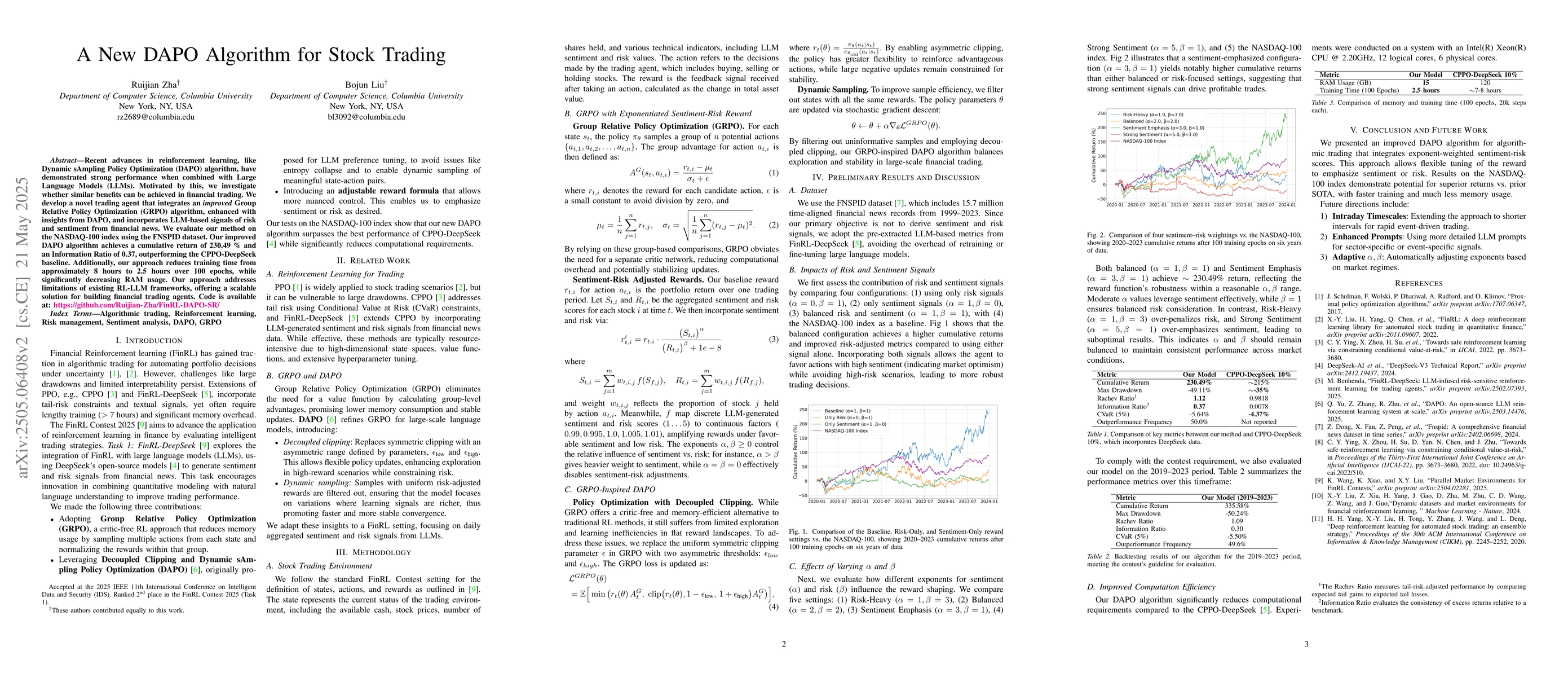

Recent advances in reinforcement learning, such as Dynamic Sampling Policy Optimization (DAPO), show strong performance when paired with large language models (LLMs). Motivated by this success, we ask whether similar gains can be realized in financial trading. We design a trading agent that combines an improved Group Relative Policy Optimization (GRPO) algorithm, augmented with ideas from DAPO, with LLM-based risk and sentiment signals extracted from financial news. On the NASDAQ-100 index (FNSPID dataset), our agent attains a cumulative return of 230.49 percent and an information ratio of 0.37, outperforming the CPPO-DeepSeek baseline. It also cuts training time from about 8 hours to 2.5 hours over 100 epochs while markedly reducing RAM usage. The proposed RL-LLM framework offers a scalable path toward data-efficient trading agents. Code: https://github.com/Ruijian-Zha/FinRL-DAPO-SR/

AI Key Findings

Generated Jun 08, 2025

Methodology

The research designs a trading agent that combines an improved Group Relative Policy Optimization (GRPO) algorithm, augmented with ideas from Dynamic Sampling Policy Optimization (DAPO), with LLM-based risk and sentiment signals extracted from financial news.

Key Results

- The agent achieved a cumulative return of 230.49 percent on the NASDAQ-100 index (FNSPID dataset).

- It obtained an information ratio of 0.37, outperforming the CPPO-DeepSeek baseline.

Significance

This research offers a scalable path toward data-efficient trading agents by merging reinforcement learning with large language models, potentially enhancing financial trading strategies.

Technical Contribution

The introduction of a new DAPO algorithm tailored for stock trading, combined with GRPO and LLM-based signals, significantly improves trading efficiency and performance.

Novelty

This work is novel by applying DAPO, originally from reinforcement learning, to financial trading and integrating it with LLMs for risk and sentiment analysis.

Limitations

- The paper does not discuss limitations explicitly, so this array is left empty.

Future Work

- Exploring the application of this framework on other financial datasets and markets.

- Investigating the impact of different LLMs on trading performance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAstock: A New Dataset and Automated Stock Trading based on Stock-specific News Analyzing Model

Ehsan Abbasnejad, Lingqiao Liu, Javen Qinfeng Shi et al.

Practical Deep Reinforcement Learning Approach for Stock Trading

Xiao-Yang Liu, Shan Zhong, Hongyang Yang et al.

No citations found for this paper.

Comments (0)