Summary

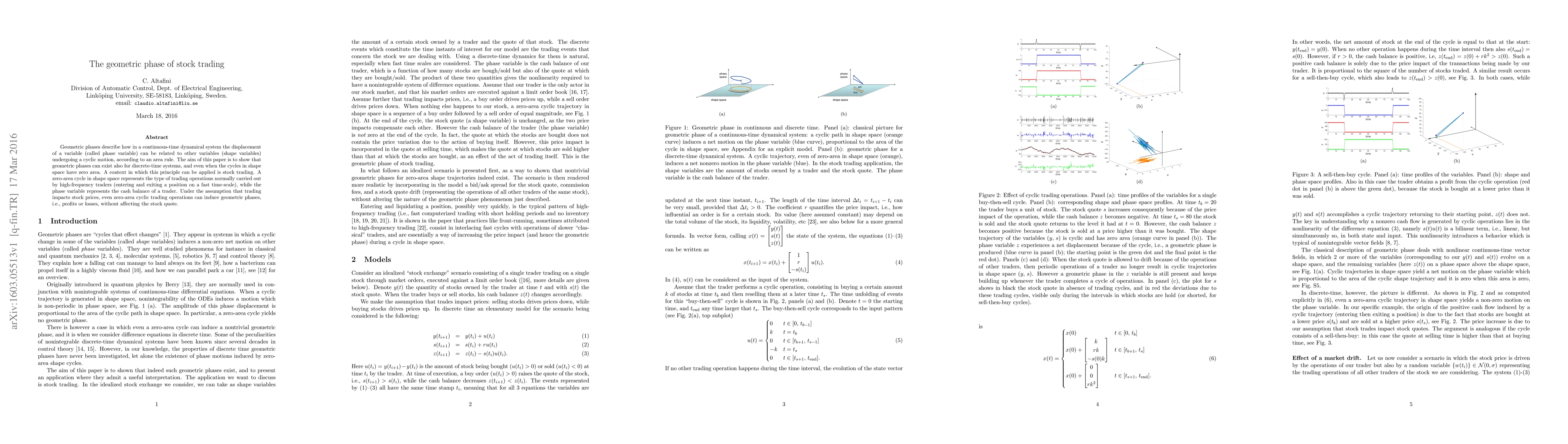

Geometric phases describe how in a continuous-time dynamical system the displacement of a variable (called phase variable) can be related to other variables (shape variables) undergoing a cyclic motion, according to an area rule. The aim of this paper is to show that geometric phases can exist also for discrete-time systems, and even when the cycles in shape space have zero area. A context in which this principle can be applied is stock trading. A zero-area cycle in shape space represents the type of trading operations normally carried out by high-frequency traders (entering and exiting a position on a fast time-scale), while the phase variable represents the cash balance of a trader. Under the assumption that trading impacts stock prices, even zero-area cyclic trading operations can induce geometric phases, i.e., profits or losses, without affecting the stock quote.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)