Summary

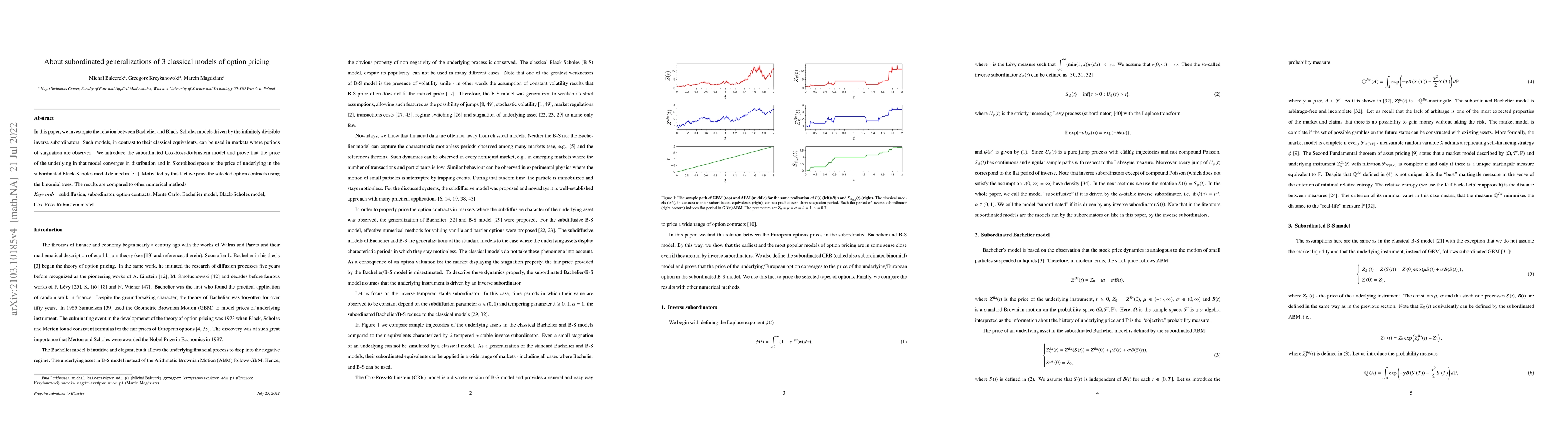

In this paper, we investigate the relation between Bachelier and Black-Scholes models driven by the infinitely divisible inverse subordinators. Such models, in contrast to their classical equivalents, can be used in markets where periods of stagnation are observed. We introduce the subordinated Cox-Ross-Rubinstein model and prove that the price of the underlying in that model converges in distribution and in Skorokhod space to the price of underlying in the subordinated Black-Scholes model defined in [31]. Motivated by this fact we price the selected option contracts using the binomial trees. The results are compared to other numerical methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOption Pricing with Mixed Levy Subordinated Price Process and Implied Probability Weighting Function

Alternatives to classical option pricing

W. Brent Lindquist, Svetlozar T. Rachev

Pragmatic Comparison Analysis of Alternative Option Pricing Models

Muhammad Usman, Chandan Kumar, Natasha Latif et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)