Summary

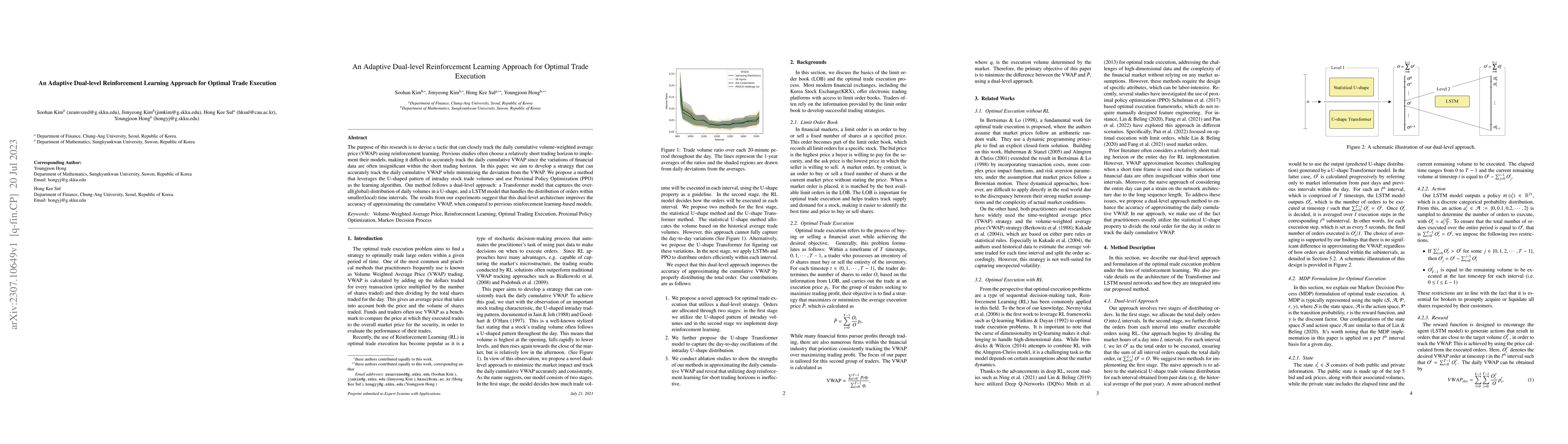

The purpose of this research is to devise a tactic that can closely track the daily cumulative volume-weighted average price (VWAP) using reinforcement learning. Previous studies often choose a relatively short trading horizon to implement their models, making it difficult to accurately track the daily cumulative VWAP since the variations of financial data are often insignificant within the short trading horizon. In this paper, we aim to develop a strategy that can accurately track the daily cumulative VWAP while minimizing the deviation from the VWAP. We propose a method that leverages the U-shaped pattern of intraday stock trade volumes and use Proximal Policy Optimization (PPO) as the learning algorithm. Our method follows a dual-level approach: a Transformer model that captures the overall(global) distribution of daily volumes in a U-shape, and a LSTM model that handles the distribution of orders within smaller(local) time intervals. The results from our experiments suggest that this dual-level architecture improves the accuracy of approximating the cumulative VWAP, when compared to previous reinforcement learning-based models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReinforcement Learning for Trade Execution with Market Impact

Patrick Cheridito, Moritz Weiss

Towards Generalizable Reinforcement Learning for Trade Execution

Jian Li, Chuheng Zhang, Li Zhao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)