Summary

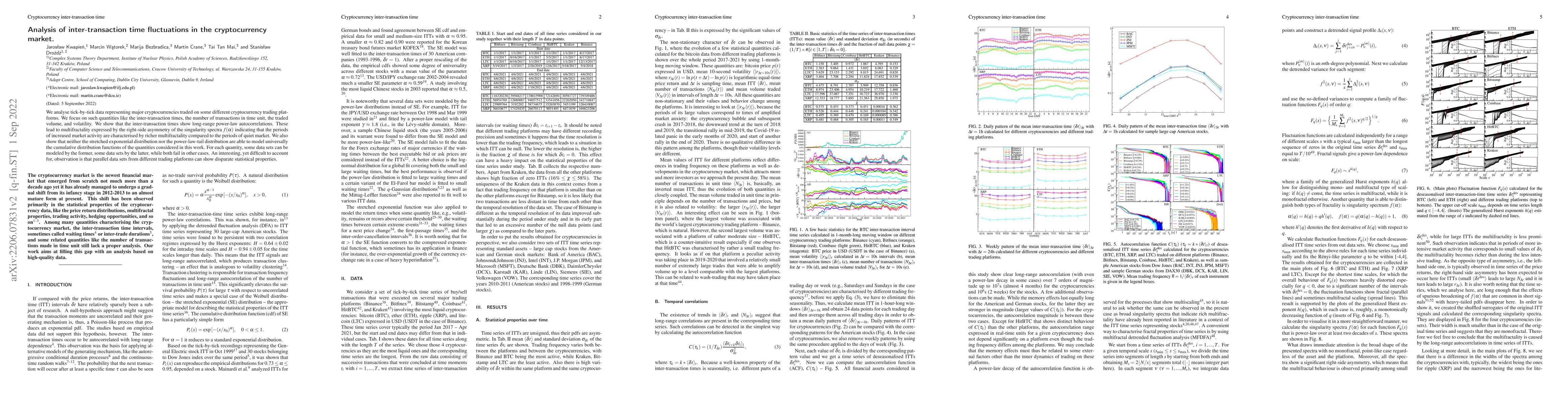

We analyse tick-by-tick data representing major cryptocurrencies traded on some different cryptocurrency trading platforms. We focus on such quantities like the inter-transaction times, the number of transactions in time unit, the traded volume, and volatility. We show that the inter-transaction times show long-range power-law autocorrelations. These lead to multifractality expressed by the right-side asymmetry of the singularity spectra $f(\alpha)$ indicating that the periods of increased market activity are characterised by richer multifractality compared to the periods of quiet market. We also show that neither the stretched exponential distribution nor the power-law-tail distribution are able to model universally the cumulative distribution functions of the quantities considered in this work. For each quantity, some data sets can be modeled by the former, some data sets by the latter, while both fail in other cases. An interesting, yet difficult to account for, observation is that parallel data sets from different trading platforms can show disparate statistical properties.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)