Summary

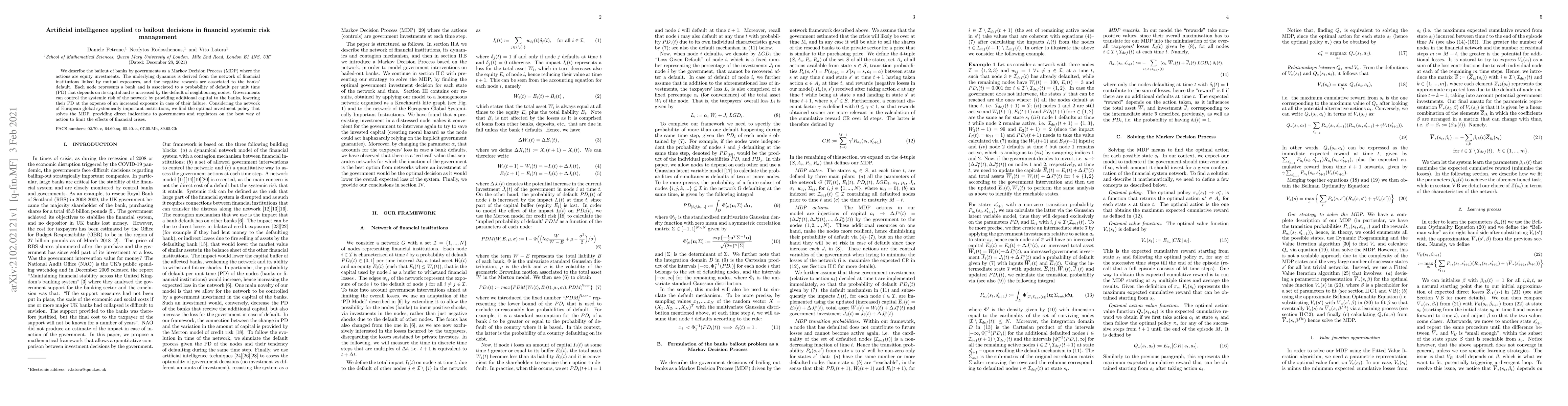

We describe the bailout of banks by governments as a Markov Decision Process (MDP) where the actions are equity investments. The underlying dynamics is derived from the network of financial institutions linked by mutual exposures, and the negative rewards are associated to the banks' default. Each node represents a bank and is associated to a probability of default per unit time (PD) that depends on its capital and is increased by the default of neighbouring nodes. Governments can control the systemic risk of the network by providing additional capital to the banks, lowering their PD at the expense of an increased exposure in case of their failure. Considering the network of European global systemically important institutions, we find the optimal investment policy that solves the MDP, providing direct indications to governments and regulators on the best way of action to limit the effects of financial crises.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Systemic Risk Bailout: A PGO Approach Based on Neural Network

Li Xia, Jiali Ma, Shushang Zhu et al.

Innovative Application of Artificial Intelligence Technology in Bank Credit Risk Management

Shuochen Bi, Wenqing Bao

| Title | Authors | Year | Actions |

|---|

Comments (0)