Authors

Summary

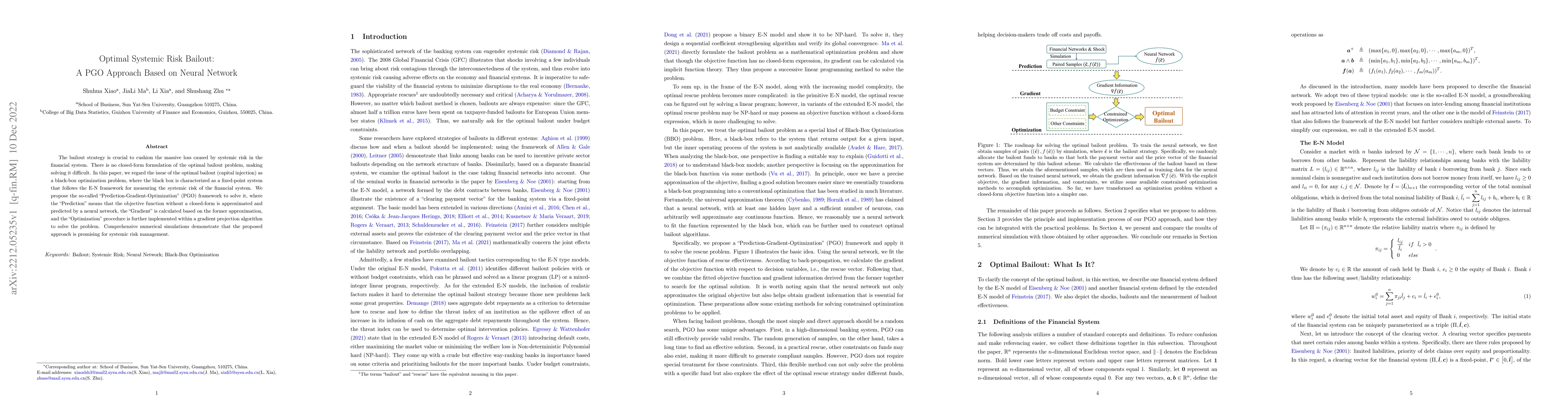

The bailout strategy is crucial to cushion the massive loss caused by systemic risk in the financial system. There is no closed-form formulation of the optimal bailout problem, making solving it difficult. In this paper, we regard the issue of the optimal bailout (capital injection) as a black-box optimization problem, where the black box is characterized as a fixed-point system that follows the E-N framework for measuring the systemic risk of the financial system. We propose the so-called ``Prediction-Gradient-Optimization'' (PGO) framework to solve it, where the ``Prediction'' means that the objective function without a closed-form is approximated and predicted by a neural network, the ``Gradient'' is calculated based on the former approximation, and the ``Optimization'' procedure is further implemented within a gradient projection algorithm to solve the problem. Comprehensive numerical simulations demonstrate that the proposed approach is promising for systemic risk management.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersArtificial intelligence applied to bailout decisions in financial systemic risk management

Vito Latora, Neofytos Rodosthenous, Daniele Petrone

Computing Systemic Risk Measures with Graph Neural Networks

Lukas Gonon, Thilo Meyer-Brandis, Niklas Weber

No citations found for this paper.

Comments (0)