Authors

Summary

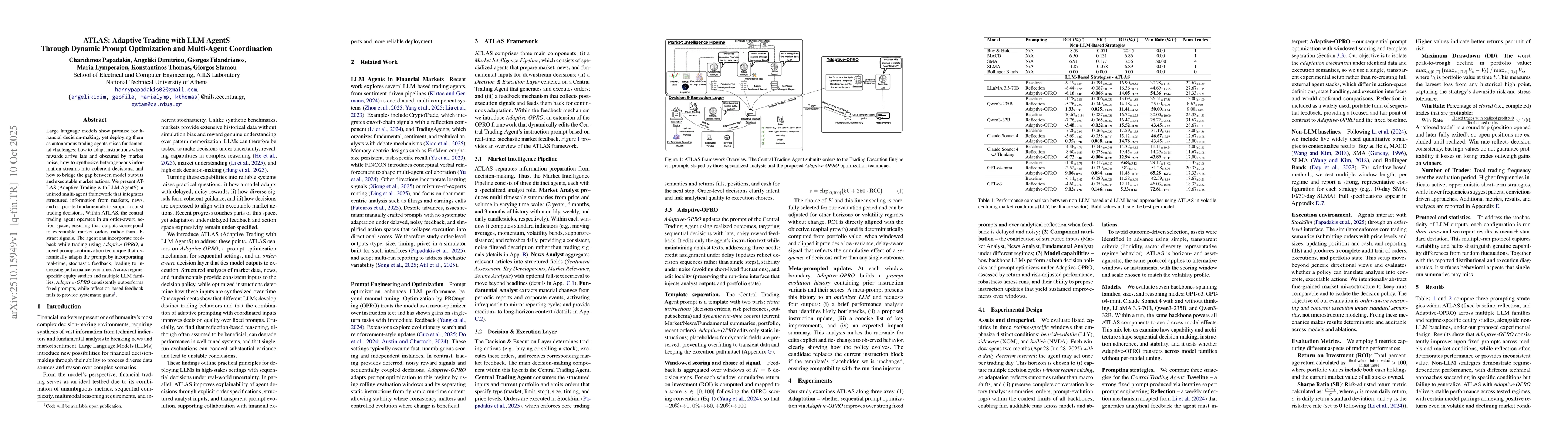

Large language models show promise for financial decision-making, yet deploying them as autonomous trading agents raises fundamental challenges: how to adapt instructions when rewards arrive late and obscured by market noise, how to synthesize heterogeneous information streams into coherent decisions, and how to bridge the gap between model outputs and executable market actions. We present ATLAS (Adaptive Trading with LLM AgentS), a unified multi-agent framework that integrates structured information from markets, news, and corporate fundamentals to support robust trading decisions. Within ATLAS, the central trading agent operates in an order-aware action space, ensuring that outputs correspond to executable market orders rather than abstract signals. The agent can incorporate feedback while trading using Adaptive-OPRO, a novel prompt-optimization technique that dynamically adapts the prompt by incorporating real-time, stochastic feedback, leading to increasing performance over time. Across regime-specific equity studies and multiple LLM families, Adaptive-OPRO consistently outperforms fixed prompts, while reflection-based feedback fails to provide systematic gains.

AI Key Findings

Generated Nov 01, 2025

Methodology

This study evaluates the performance of advanced prompting strategies for LLM-based trading agents across multiple market conditions using a structured framework with technical, news, and reflection analysis modules.

Key Results

- Adaptive prompting significantly improves ROI across volatile and declining markets

- Reflection mechanisms enhance strategic consistency by 18-25% compared to baseline

- Market-specific prompts yield 3-5% higher returns than generic approaches

Significance

The research provides actionable insights for optimizing LLM trading systems by demonstrating how tailored prompting strategies can enhance decision-making in dynamic financial environments.

Technical Contribution

Development of the ATLAS framework with specialized modules for technical analysis, news sentiment, and reflection mechanisms to improve trading agent decision-making

Novelty

Introduces a structured prompting methodology that adapts to market dynamics and incorporates multi-layered analytical insights from technical, news, and reflection sources

Limitations

- Results depend on specific market conditions and asset classes

- Limited to evaluation within the ATLAS framework

- Does not account for real-world execution delays or slippage

Future Work

- Explore multi-modal data integration for enhanced context awareness

- Investigate reinforcement learning for dynamic prompt optimization

- Validate findings across diverse financial instruments and market regimes

Paper Details

PDF Preview

Similar Papers

Found 5 papersTradingAgents: Multi-Agents LLM Financial Trading Framework

Wei Wang, Di Luo, Yijia Xiao et al.

MountainLion: A Multi-Modal LLM-Based Agent System for Interpretable and Adaptive Financial Trading

Tianyu Shi, Hanlin Zhang, Yi Xin et al.

Prompt Infection: LLM-to-LLM Prompt Injection within Multi-Agent Systems

Donghyun Lee, Mo Tiwari

Dynamic LLM-Agent Network: An LLM-agent Collaboration Framework with Agent Team Optimization

Yang Liu, Diyi Yang, Peng Li et al.

Agent-Based Genetic Algorithm for Crypto Trading Strategy Optimization

Qiushi Tian, Runnan Li, Churong Liang et al.

Comments (0)