Summary

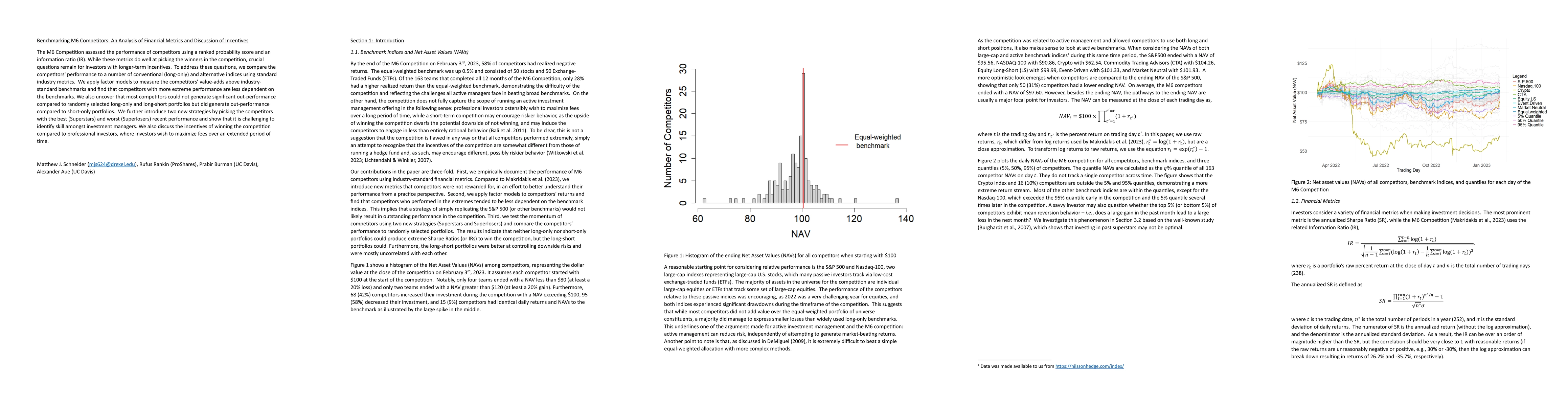

The M6 Competition assessed the performance of competitors using a ranked probability score and an information ratio (IR). While these metrics do well at picking the winners in the competition, crucial questions remain for investors with longer-term incentives. To address these questions, we compare the competitors' performance to a number of conventional (long-only) and alternative indices using standard industry metrics. We apply factor models to the competitors' returns and show the difficulty for any competitor to demonstrate a statistically significant value-add above industry-standard benchmarks within the short timeframe of the competition. We also uncover that most competitors generated lower risk-adjusted returns and lower maximum drawdowns than randomly selected portfolios, and that most competitors could not generate significant out-performance in raw returns. We further introduce two new strategies by picking the competitors with the best (Superstars) and worst (Superlosers) recent performance and show that it is challenging to identify skill amongst investment managers. Overall, our findings highlight the difference in incentives for competitors over professional investors, where the upside of winning the competition dwarfs the potential downside of not winning to maximize fees over an extended period of time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)