Authors

Summary

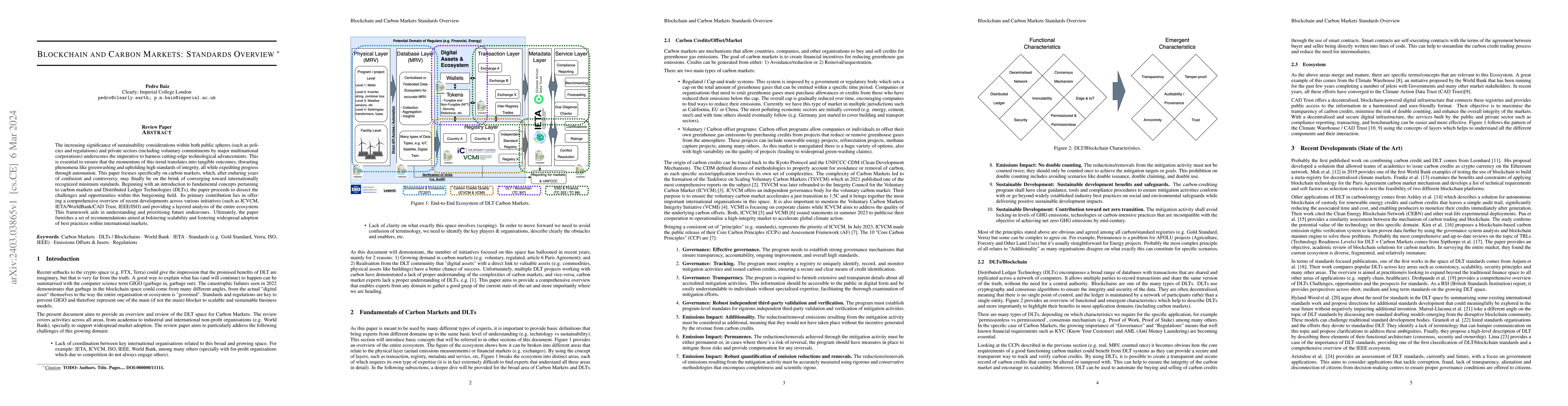

The increasing significance of sustainability considerations within both public spheres (such as policies and regulations) and private sectors (including voluntary commitments by major multinational corporations) underscores the imperative to harness cutting-edge technological advancements. This is essential to ensure that the momentum of this trend translates into tangible outcomes, thwarting phenomena like greenwashing and upholding high standards of integrity, all while expediting progress through automation. This paper focuses specifically on carbon markets, which, after enduring years of confusion and controversy, may finally be on the brink of converging toward internationally recognized minimum standards. Beginning with an introduction to fundamental concepts pertaining to carbon markets and Distributed Ledger Technologies (DLTs), the paper proceeds to dissect the challenges and opportunities within this burgeoning field. Its primary contribution lies in offering a comprehensive overview of recent developments across various initiatives (such as ICVCM, IETA/WorldBank/CAD Trust, IEEE/ISO) and providing a layered analysis of the entire ecosystem. This framework aids in understanding and prioritising future endeavours. Ultimately, the paper furnishes a set of recommendations aimed at bolstering scalability and fostering widespread adoption of best practices within international markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBlockchain-Driven Solutions for Carbon Credit Trading: A Decentralized Platform for SMEs

Yun-Cheng Tsai

Bridging financial gaps for infrastructure climate adaptation via integrated carbon markets

Jun Wang, Chao Li, Chao Fan et al.

No citations found for this paper.

Comments (0)