Summary

It is "well known" that there is no explicit expression for the Black-Scholes implied volatility. We prove that, as a function of underlying, strike, and call price, implied volatility does not belong to the class of D-finite functions. This does not rule out all explicit expressions, but shows that implied volatility does not belong to a certain large class, which contains many elementary functions and classical special functions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

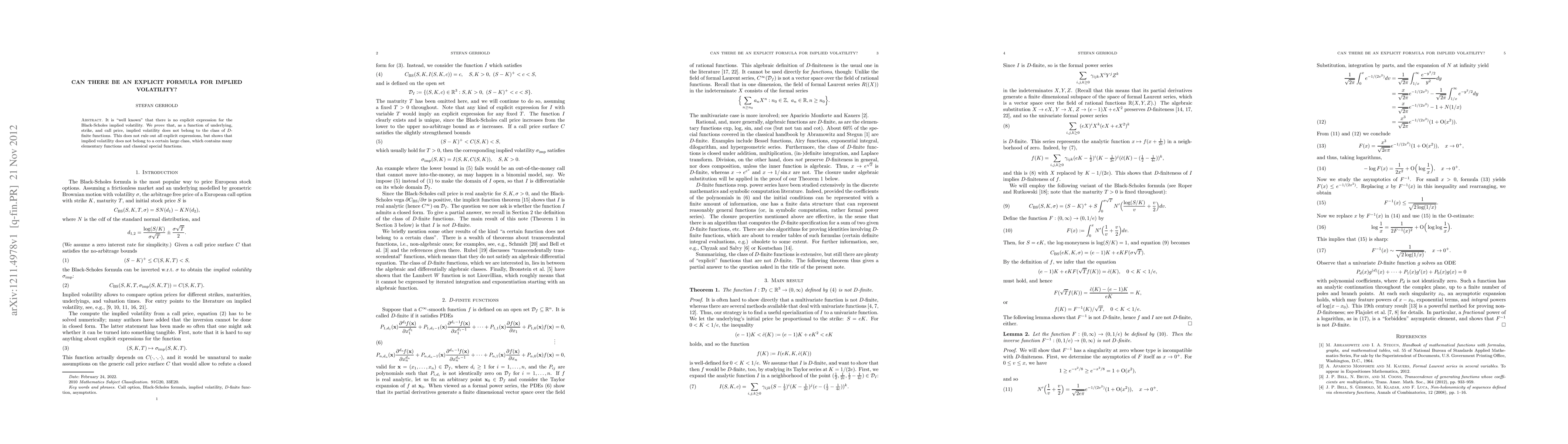

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)