Authors

Summary

This paper studies a systemic risk control problem by the central bank, which dynamically plans monetary supply to stabilize the interbank system with borrowing and lending activities. Facing both heterogeneity among banks and the common noise, the central bank aims to find an optimal strategy to minimize the average distance between log-monetary reserves of all banks and the benchmark of some target steady levels. A weak formulation is adopted, and an optimal randomized control can be obtained in the system with finite banks by applying Ekeland's variational principle. As the number of banks grows large, we prove the convergence of optimal strategies using the Gamma-convergence argument, which yields an optimal weak control in the mean field model. It is shown that this mean field optimal control is associated to the solution of a stochastic Fokker-Planck-Kolmogorov (FPK) equation, for which the uniqueness of the solution is established under some mild conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

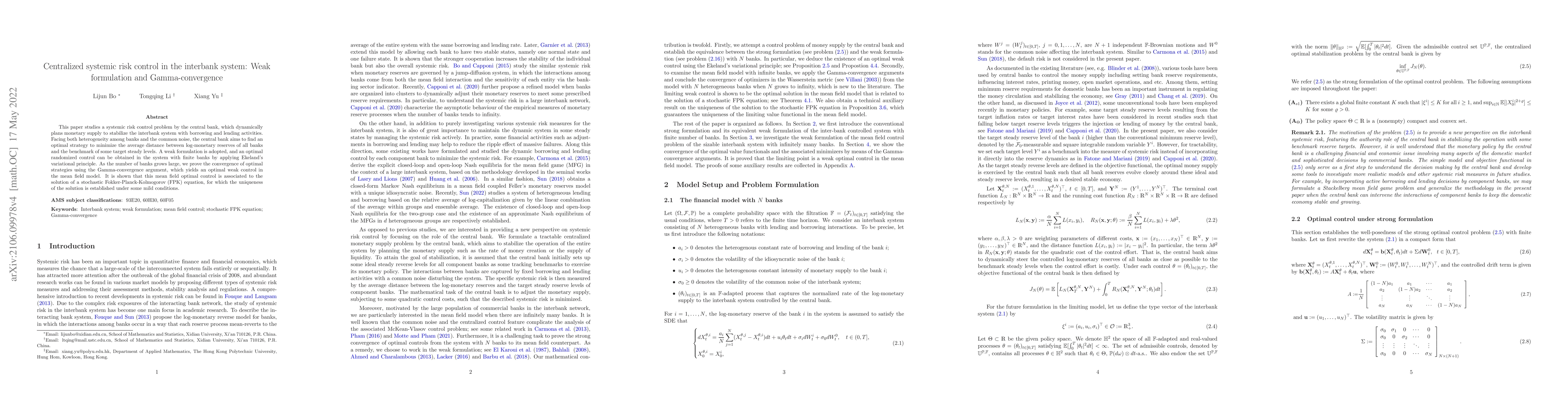

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)