Authors

Summary

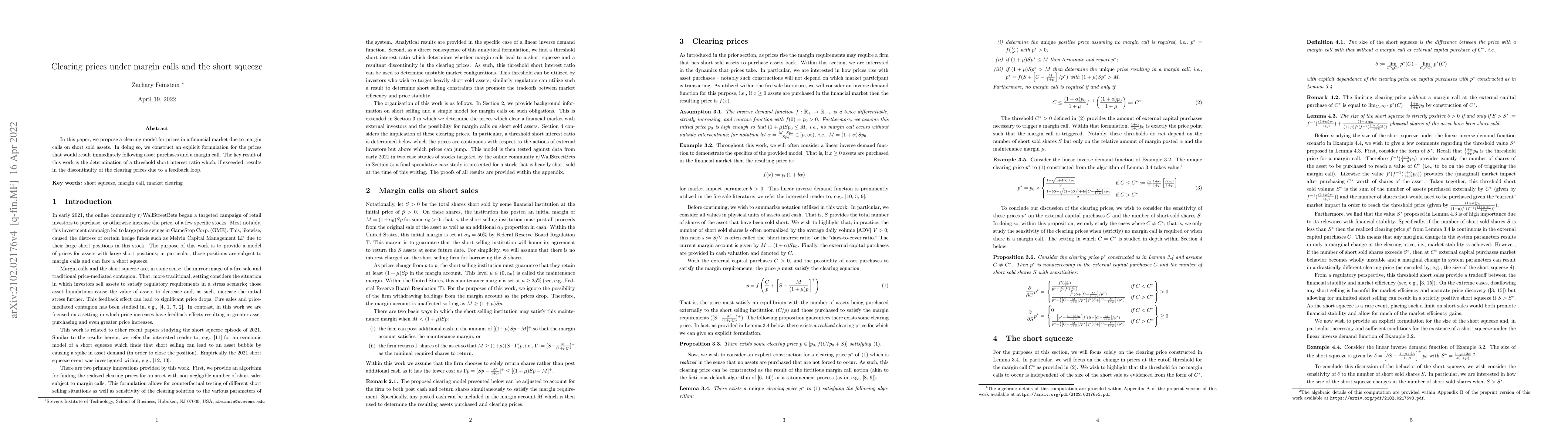

In this paper, we propose a clearing model for prices in a financial markets due to margin calls on short sold assets. In doing so, we construct an explicit formulation for the prices that would result immediately following asset purchases and a margin call. The key result of this work is the determination of a threshold short interest ratio which, if exceeded, results in the discontinuity of the clearing prices due to a feedback loop.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMiMIC: Multi-Modal Indian Earnings Calls Dataset to Predict Stock Prices

Sudip Kumar Naskar, Sohom Ghosh, Arnab Maji

| Title | Authors | Year | Actions |

|---|

Comments (0)