Summary

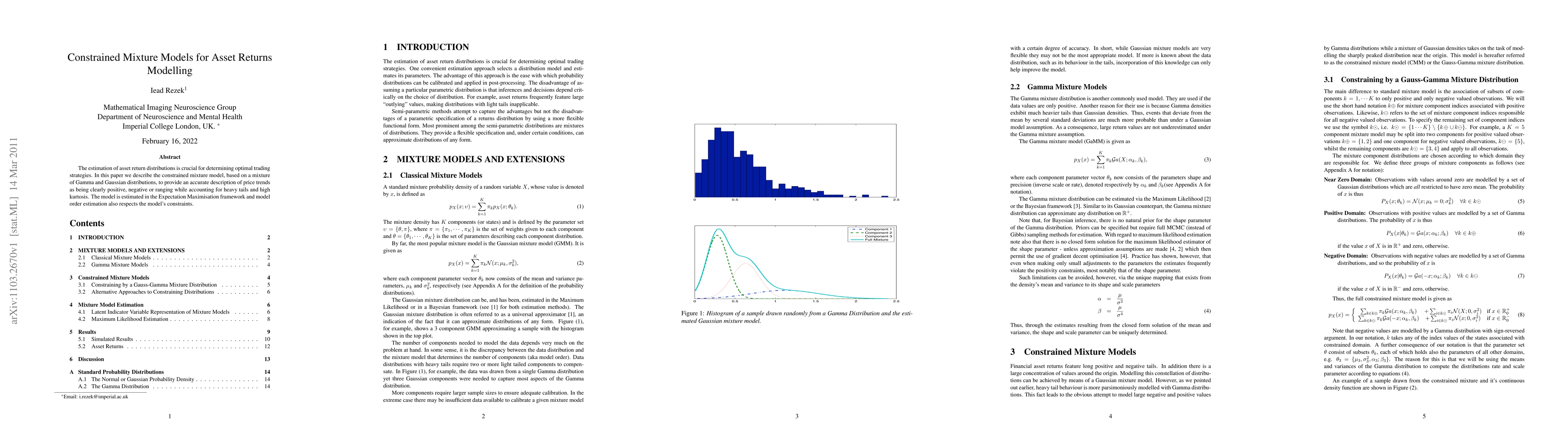

The estimation of asset return distributions is crucial for determining optimal trading strategies. In this paper we describe the constrained mixture model, based on a mixture of Gamma and Gaussian distributions, to provide an accurate description of price trends as being clearly positive, negative or ranging while accounting for heavy tails and high kurtosis. The model is estimated in the Expectation Maximisation framework and model order estimation also respects the model's constraints.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGeneralized Distribution Prediction for Asset Returns

María Óskarsdóttir, Ísak Pétursson

| Title | Authors | Year | Actions |

|---|

Comments (0)