Authors

Summary

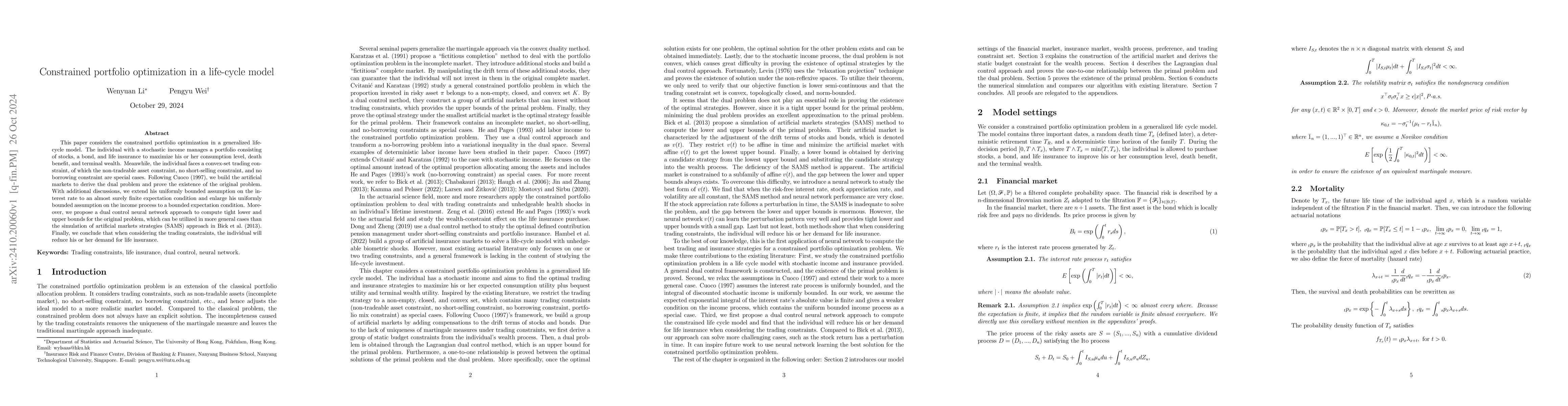

This paper considers the constrained portfolio optimization in a generalized life-cycle model. The individual with a stochastic income manages a portfolio consisting of stocks, a bond, and life insurance to maximize his or her consumption level, death benefit, and terminal wealth. Meanwhile, the individual faces a convex-set trading constraint, of which the non-tradeable asset constraint, no short-selling constraint, and no borrowing constraint are special cases. Following Cuoco (1997), we build the artificial markets to derive the dual problem and prove the existence of the original problem. With additional discussions, we extend his uniformly bounded assumption on the interest rate to an almost surely finite expectation condition and enlarge his uniformly bounded assumption on the income process to a bounded expectation condition. Moreover, we propose a dual control neural network approach to compute tight lower and upper bounds for the original problem, which can be utilized in more general cases than the simulation of artificial markets strategies (SAMS) approach in Bick et al. (2013). Finally, we conclude that when considering the trading constraints, the individual will reduce his or her demand for life insurance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersCardinality-constrained Distributionally Robust Portfolio Optimization

Yuichi Takano, Ken Kobayashi, Kazuhide Nakata

No citations found for this paper.

Comments (0)