Summary

In this paper, we are interested in continuous time models in which the index level induces some feedback on the dynamics of its composing stocks. More precisely, we propose a model in which the log-returns of each stock may be decomposed into a systemic part proportional to the log-returns of the index plus an idiosyncratic part. We show that, when the number of stocks in the index is large, this model may be approximated by a local volatility model for the index and a stochastic volatility model for each stock with volatility driven by the index. This result is useful in a calibration perspective : it suggests that one should first calibrate the local volatility of the index and then calibrate the dynamics of each stock. We explain how to do so in the limiting simplified model and in the original model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

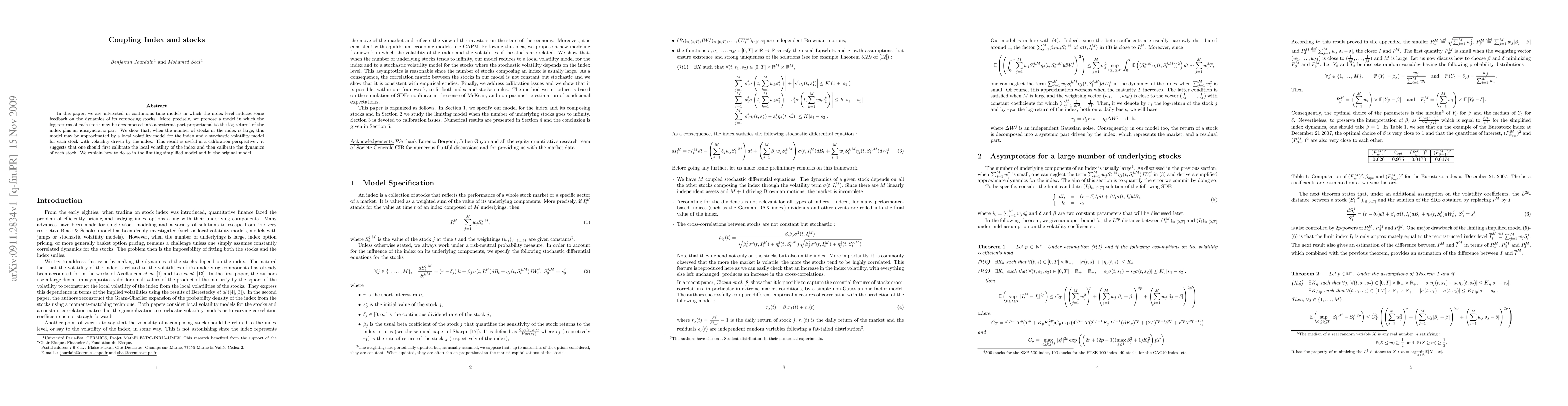

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrediction of Stocks Index Price using Quantum GANs

Gopal Ramesh Dahale, Sai Nandan Morapakula, Sangram Deshpande et al.

Comparison of Markowitz Model and Single-Index Model on Portfolio Selection of Malaysian Stocks

Zhang Chern Lee, Wei Yun Tan, Hoong Khen Koo et al.

Factor Exposure Heterogeneity in Green and Brown Stocks

David Ardia, Keven Bluteau, Gabriel Lortie-Cloutier et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)