Authors

Summary

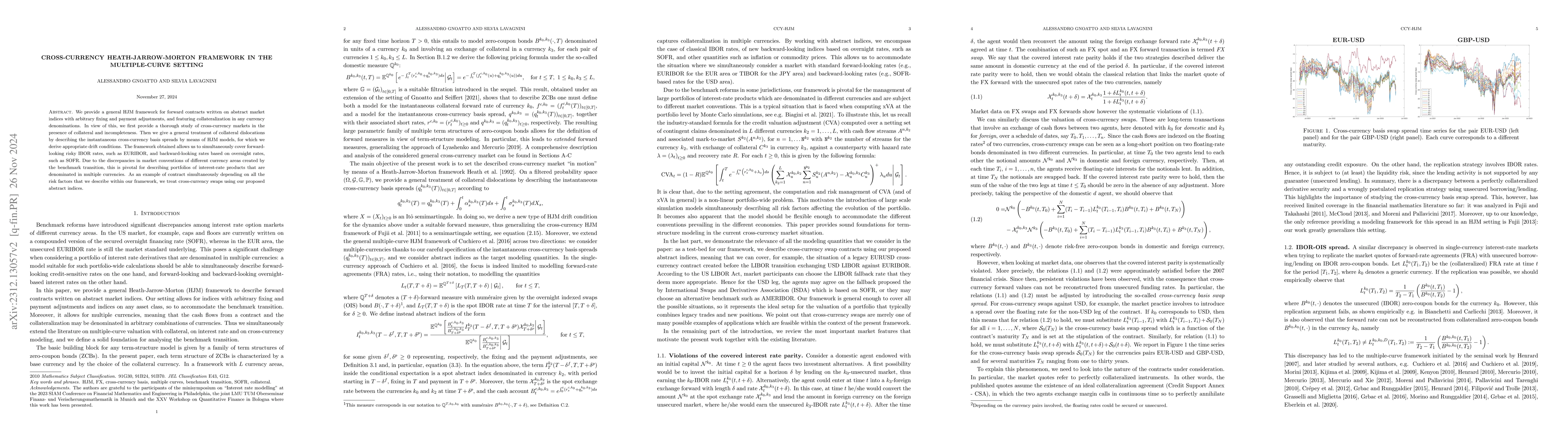

We provide a general HJM framework for forward contracts written on abstract market indices with arbitrary fixing and payment adjustments. We allow for indices on any asset class, featuring collateralization in arbitrary currency denominations. The framework is pivotal for describing portfolios of interest rate products which are denominated in multiple currencies. The benchmark transition has created significant discrepancies among the market conventions of different currency areas: our framework simultaneously covers forward-looking risky IBOR rates, such as EURIBOR, and backward-looking rates based on overnight rates, such as SOFR. In view of this, we provide a thorough study of cross-currency markets in the presence of collateral, where the cash flows of the contract and the margin account can be denominated in arbitrary combinations of currencies. We finally consider cross-currency swap contracts as an example of a contract simultaneously depending on all the risk factors that we describe within our framework.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Heath-Jarrow-Morton framework for energy markets: a pragmatic approach

Matteo Gardini, Edoardo Santilli

No citations found for this paper.

Comments (0)