Authors

Summary

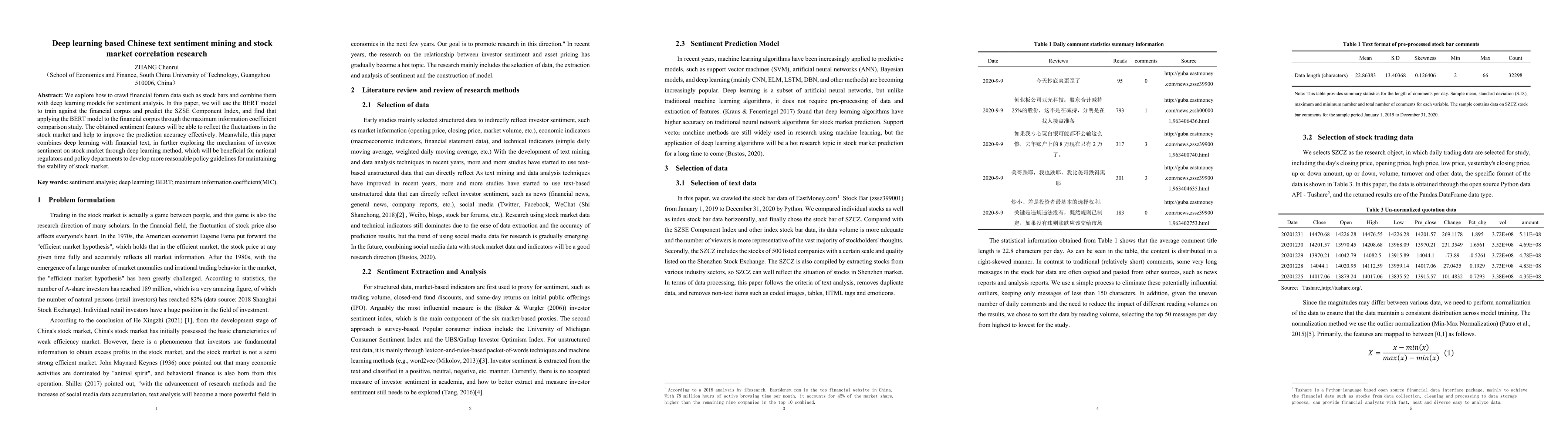

We explore how to crawl financial forum data such as stock bars and combine them with deep learning models for sentiment analysis. In this paper, we will use the BERT model to train against the financial corpus and predict the SZSE Component Index, and find that applying the BERT model to the financial corpus through the maximum information coefficient comparison study. The obtained sentiment features will be able to reflect the fluctuations in the stock market and help to improve the prediction accuracy effectively. Meanwhile, this paper combines deep learning with financial text, in further exploring the mechanism of investor sentiment on stock market through deep learning method, which will be beneficial for national regulators and policy departments to develop more reasonable policy guidelines for maintaining the stability of stock market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersResearch on the correlation between text emotion mining and stock market based on deep learning

Chenrui Zhang

Analyst Reports and Stock Performance: Evidence from the Chinese Market

Rui Liu, Yujia Hu, Jiayou Liang et al.

No citations found for this paper.

Comments (0)