Authors

Summary

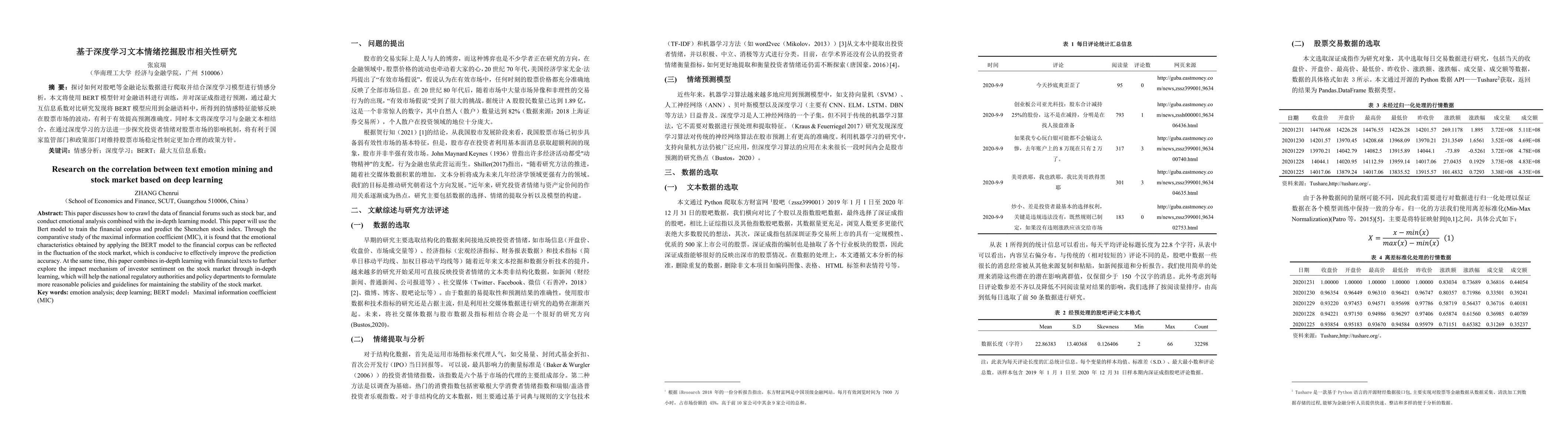

This paper discusses how to crawl the data of financial forums such as stock bar, and conduct emotional analysis combined with the in-depth learning model. This paper will use the Bert model to train the financial corpus and predict the Shenzhen stock index. Through the comparative study of the maximal information coefficient (MIC), it is found that the emotional characteristics obtained by applying the BERT model to the financial corpus can be reflected in the fluctuation of the stock market, which is conducive to effectively improve the prediction accuracy. At the same time, this paper combines in-depth learning with financial texts to further explore the impact mechanism of investor sentiment on the stock market through in-depth learning, which will help the national regulatory authorities and policy departments to formulate more reasonable policies and guidelines for maintaining the stability of the stock market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)