Authors

Summary

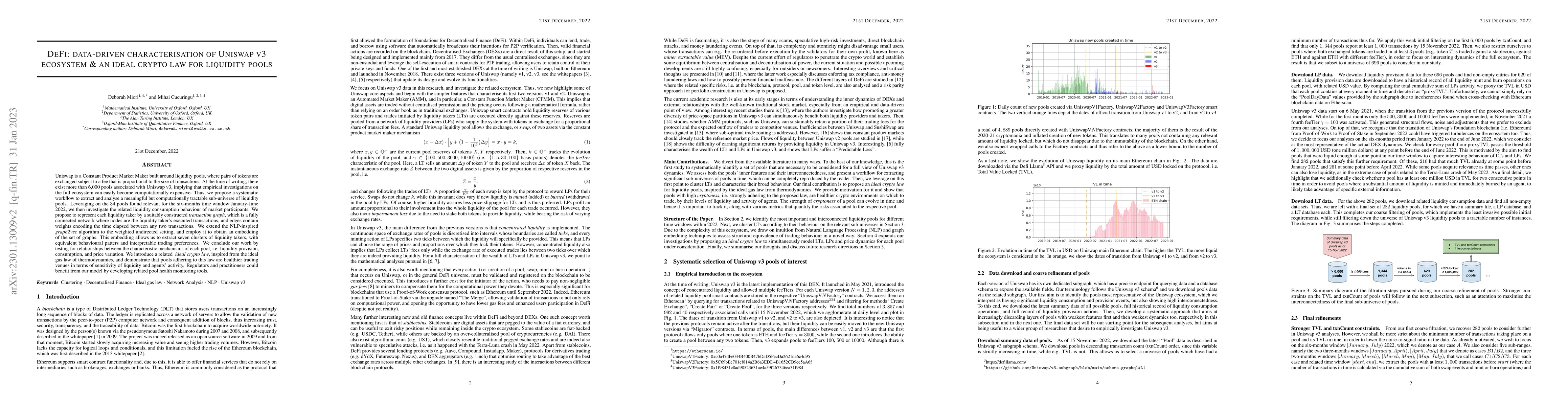

Uniswap is a Constant Product Market Maker built around liquidity pools, where pairs of tokens are exchanged subject to a fee that is proportional to the size of transactions. At the time of writing, there exist more than 6,000 pools associated with Uniswap v3, implying that empirical investigations on the full ecosystem can easily become computationally expensive. Thus, we propose a systematic workflow to extract and analyse a meaningful but computationally tractable sub-universe of liquidity pools. Leveraging on the 34 pools found relevant for the six-months time window January-June 2022, we then investigate the related liquidity consumption behaviour of market participants. We propose to represent each liquidity taker by a suitably constructed transaction graph, which is a fully connected network where nodes are the liquidity taker's executed transactions, and edges contain weights encoding the time elapsed between any two transactions. We extend the NLP-inspired graph2vec algorithm to the weighted undirected setting, and employ it to obtain an embedding of the set of graphs. This embedding allows us to extract seven clusters of liquidity takers, with equivalent behavioural patters and interpretable trading preferences. We conclude our work by testing for relationships between the characteristic mechanisms of each pool, i.e. liquidity provision, consumption, and price variation. We introduce a related ideal crypto law, inspired from the ideal gas law of thermodynamics, and demonstrate that pools adhering to this law are healthier trading venues in terms of sensitivity of liquidity and agents' activity. Regulators and practitioners could benefit from our model by developing related pool health monitoring tools.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisks and Returns of Uniswap V3 Liquidity Providers

Roger Wattenhofer, Lioba Heimbach, Eric Schertenleib

Backtesting Framework for Concentrated Liquidity Market Makers on Uniswap V3 Decentralized Exchange

Andrey Urusov, Rostislav Berezovskiy, Yury Yanovich

| Title | Authors | Year | Actions |

|---|

Comments (0)