Authors

Summary

We give a complete description of the third-moment (skewness) characteristics of both linear and nonlinear momentum trading strategies, the latter being understood as transformations of a normalised moving-average filter (EMA). We explain in detail why the skewness is generally positive and has a term structure. This paper is a synthesis of two papers published by the author in RISK in 2012, with some updates and comments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

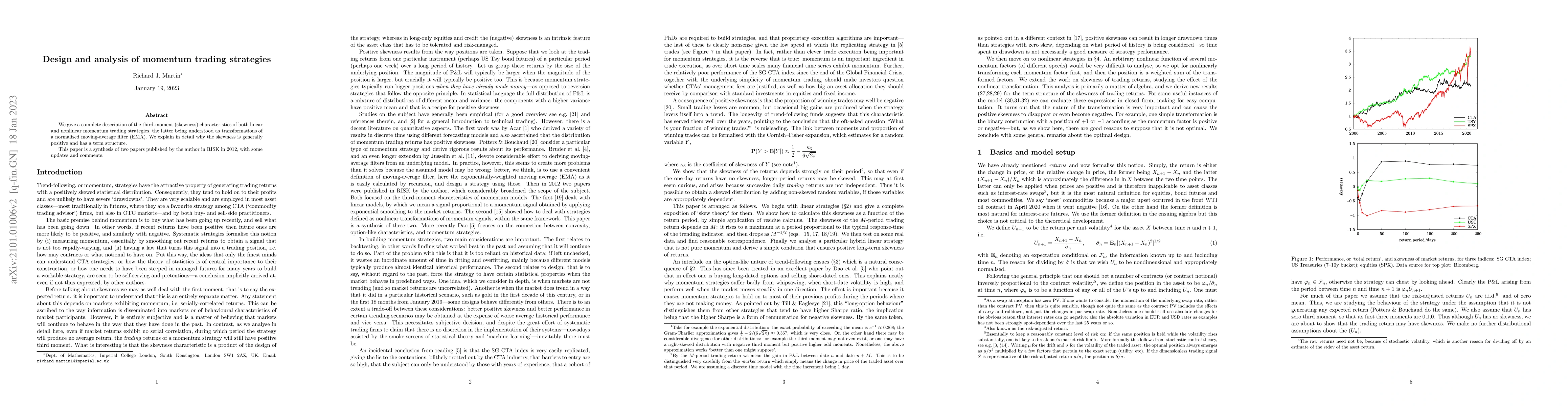

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModel-free Analysis of Dynamic Trading Strategies

Renyuan Xu, Anna Ananova, Rama Cont

| Title | Authors | Year | Actions |

|---|

Comments (0)