Summary

This paper investigates the degree of efficiency for the Moscow Stock Exchange. A market is called efficient if prices of its assets fully reflect all available information. We show that the degree of market efficiency is significantly low for most of the months from 2012 to 2021. We calculate the degree of market efficiency by (i) filtering out regularities in financial data and (ii) computing the Shannon entropy of the filtered return time series. We have developed a simple method for estimating volatility and price staleness in empirical data, in order to filter out such regularity patterns from return time series. The resulting financial time series of stocks' returns are then clustered into different groups according to some entropy measures. In particular, we use the Kullback-Leibler distance and a novel entropy metric capturing the co-movements between pairs of stocks. By using Monte Carlo simulations, we are then able to identify the time periods of market inefficiency for a group of 18 stocks. The inefficiency of the Moscow Stock Exchange that we have detected is a signal of the possibility of devising profitable strategies, net of transaction costs. The deviation from the efficient behavior for a stock strongly depends on the industrial sector it belongs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

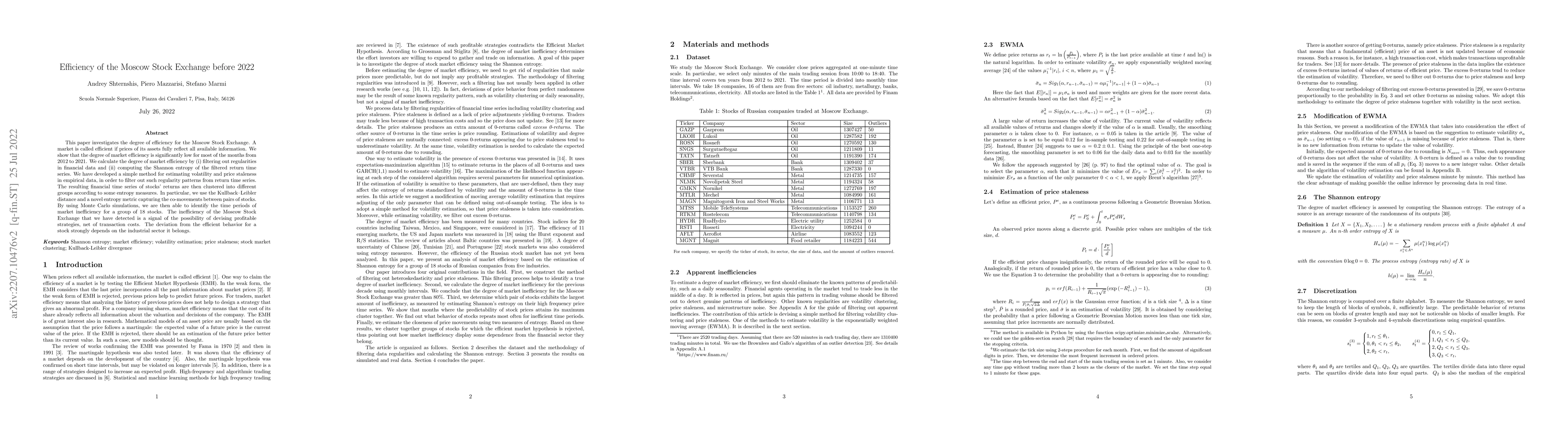

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)