Authors

Summary

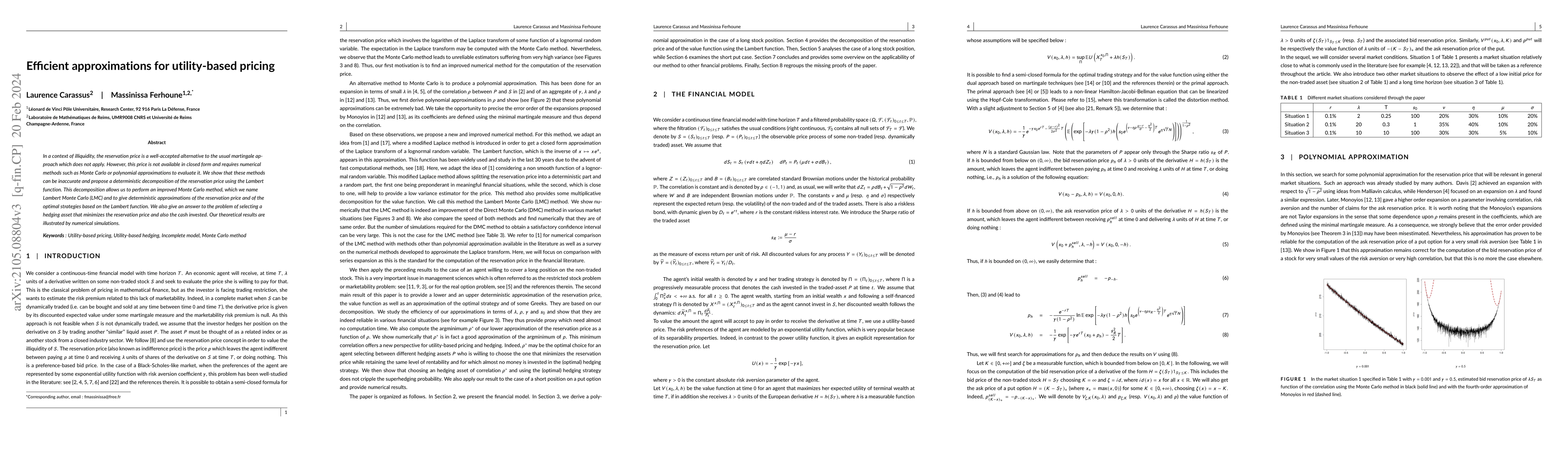

In a context of illiquidity, the reservation price is a well-accepted alternative to the usual martingale approach which does not apply. However, this price is not available in closed form and requires numerical methods such as Monte Carlo or polynomial approximations to evaluate it. We show that these methods can be inaccurate and propose a deterministic decomposition of the reservation price using the Lambert function. This decomposition allows us to perform an improved Monte Carlo method, which we name Lambert Monte Carlo (LMC) and to give deterministic approximations of the reservation price and of the optimal strategies based on the Lambert function. We also give an answer to the problem of selecting a hedging asset that minimizes the reservation price and also the cash invested. Our theoretical results are illustrated by numerical simulations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUtility-based Resource Allocation and Pricing for Serverless Computing

Kannan Ramchandran, Vipul Gupta, Soham Phade et al.

No citations found for this paper.

Comments (0)