Summary

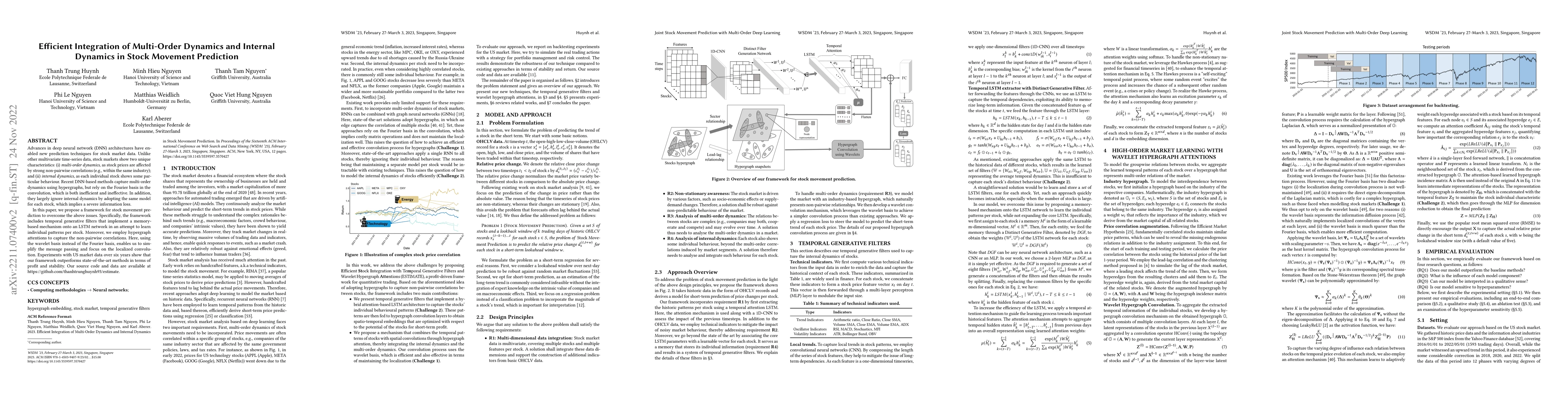

Advances in deep neural network (DNN) architectures have enabled new prediction techniques for stock market data. Unlike other multivariate time-series data, stock markets show two unique characteristics: (i) \emph{multi-order dynamics}, as stock prices are affected by strong non-pairwise correlations (e.g., within the same industry); and (ii) \emph{internal dynamics}, as each individual stock shows some particular behaviour. Recent DNN-based methods capture multi-order dynamics using hypergraphs, but rely on the Fourier basis in the convolution, which is both inefficient and ineffective. In addition, they largely ignore internal dynamics by adopting the same model for each stock, which implies a severe information loss. In this paper, we propose a framework for stock movement prediction to overcome the above issues. Specifically, the framework includes temporal generative filters that implement a memory-based mechanism onto an LSTM network in an attempt to learn individual patterns per stock. Moreover, we employ hypergraph attentions to capture the non-pairwise correlations. Here, using the wavelet basis instead of the Fourier basis, enables us to simplify the message passing and focus on the localized convolution. Experiments with US market data over six years show that our framework outperforms state-of-the-art methods in terms of profit and stability. Our source code and data are available at \url{https://github.com/thanhtrunghuynh93/estimate}.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinMamba: Market-Aware Graph Enhanced Multi-Level Mamba for Stock Movement Prediction

Yifan Hu, Shu-Tao Xia, Tao Dai et al.

Higher Order Transformers: Enhancing Stock Movement Prediction On Multimodal Time-Series Data

Reihaneh Rabbany, Guillaume Rabusseau, Soroush Omranpour

| Title | Authors | Year | Actions |

|---|

Comments (0)