Authors

Summary

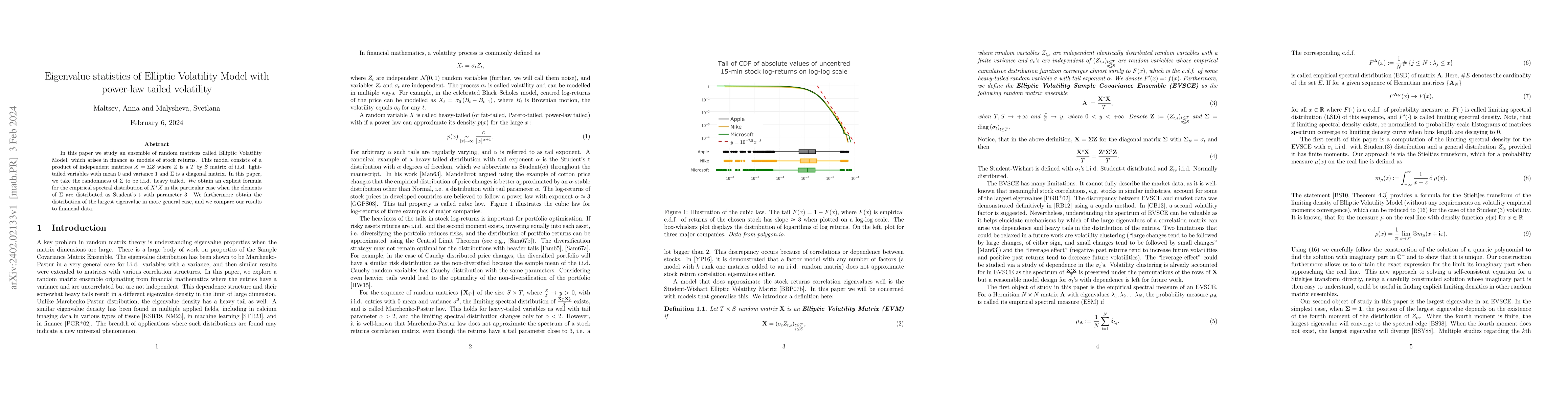

In this paper we study an ensemble of random matrices called Elliptic Volatility Model, which arises in finance as models of stock returns. This model consists of a product of independent matrices $X = \Sigma Z $ where $Z$ is a $T$ by $S$ matrix of i.i.d. light-tailed variables with mean 0 and variance 1 and $\Sigma$ is a diagonal matrix. In this paper, we take the randomness of $\Sigma$ to be i.i.d. heavy tailed. We obtain an explicit formula for the empirical spectral distribution of $X^*X$ in the particular case when the elements of $\Sigma$ are distributed as Student's t with parameter 3. We furthermore obtain the distribution of the largest eigenvalue in more general case, and we compare our results to financial data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPower law in Sandwiched Volterra Volatility model

Giulia Di Nunno, Anton Yurchenko-Tytarenko

Convergence of Heavy-Tailed Hawkes Processes and the Microstructure of Rough Volatility

Wei Xu, Ulrich Horst, Rouyi Zhang

No citations found for this paper.

Comments (0)