Authors

Summary

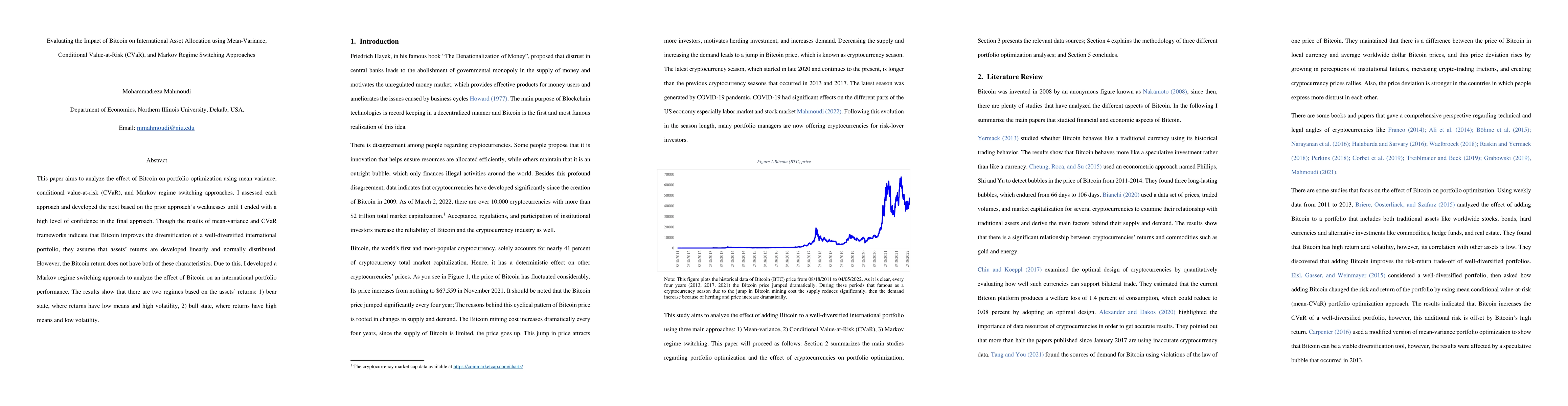

This paper aims to analyze the effect of Bitcoin on portfolio optimization using mean-variance, conditional value-at-risk (CVaR), and Markov regime switching approaches. I assessed each approach and developed the next based on the prior approach's weaknesses until I ended with a high level of confidence in the final approach. Though the results of mean-variance and CVaR frameworks indicate that Bitcoin improves the diversification of a well-diversified international portfolio, they assume that assets' returns are developed linearly and normally distributed. However, the Bitcoin return does not have both of these characteristics. Due to this, I developed a Markov regime switching approach to analyze the effect of Bitcoin on an international portfolio performance. The results show that there are two regimes based on the assets' returns: 1- bear state, where returns have low means and high volatility, 2- bull state, where returns have high means and low volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModelling and Predicting the Conditional Variance of Bitcoin Daily Returns: Comparsion of Markov Switching GARCH and SV Models

Vahidin Jeleskovic, Dennis Koch, Zahid I. Younas

Portfolio analysis with mean-CVaR and mean-CVaR-skewness criteria based on mean-variance mixture models

Ruoyu Sun, Kai He, Svetlozar T. Rachev et al.

Dynamic Asset Allocation with Asset-Specific Regime Forecasts

John M. Mulvey, Yizhan Shu, Chenyu Yu

| Title | Authors | Year | Actions |

|---|

Comments (0)