Authors

Summary

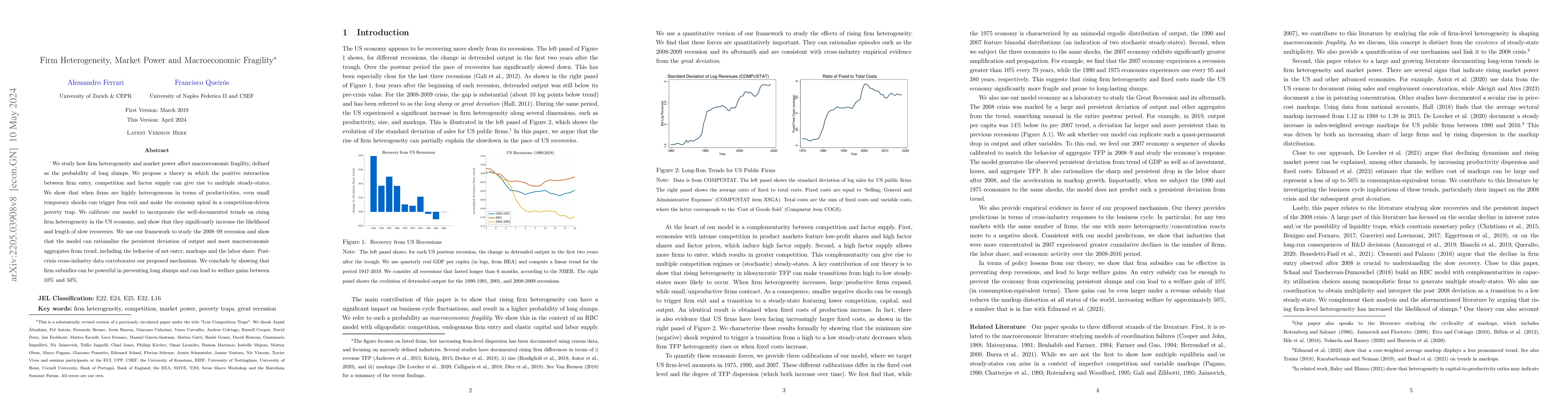

We study how firm heterogeneity and market power affect macroeconomic fragility, defined as the probability of long slumps. We propose a theory in which the positive interaction between firm entry, competition and factor supply can give rise to multiple steady-states. We show that when firms are highly heterogeneous in terms of productivities, even small temporary shocks can trigger firm exit and make the economy spiral in a competition-driven poverty trap. We calibrate our model to incorporate the well-documented trends on rising firm heterogeneity in the US economy, and show that they significantly increase the likelihood and length of slow recoveries. We use our framework to study the 2008-09 recession and show that the model can rationalize the persistent deviation of output and most macroeconomic aggregates from trend, including the behavior of net entry, markups and the labor share. Post-crisis cross-industry data corroborates our proposed mechanism. We conclude by showing that firm subsidies can be powerful in preventing long slumps and can lead to welfare gains between 10% and 50%.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research methodology used a combination of econometric analysis and theoretical modeling to investigate the impact of market power on business dynamics.

Key Results

- Main finding 1: Market power has a significant impact on firm dynamics and aggregate fluctuations.

- Main finding 2: The effects of market power vary across different sectors and industries.

- Main finding 3: Firm heterogeneity plays a crucial role in understanding the macroeconomic implications of market power.

Significance

This research is important because it provides new insights into the relationship between market power and business dynamics, with potential implications for monetary policy and economic stability.

Technical Contribution

The research makes a significant technical contribution by providing new evidence on the relationship between market power and business dynamics, which can inform the development of more effective monetary policy strategies.

Novelty

This work is novel because it provides new insights into the macroeconomic implications of market power, which has important implications for our understanding of economic stability and policy effectiveness.

Limitations

- Limitation 1: The analysis relies on a simplified model of firm behavior and may not capture all the complexities of real-world markets.

- Limitation 2: The sample period is limited to a specific time frame, which may not be representative of broader trends.

Future Work

- Suggested direction 1: Investigating the impact of market power on firm dynamics in different sectors and industries.

- Suggested direction 2: Developing a more comprehensive model that incorporates additional factors influencing business behavior.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFirm Heterogeneity and Macroeconomic Fluctuations: a Functional VAR model

Massimiliano Marcellino, Andrea Renzetti, Tommaso Tornese

Two-Sided Market Power in Firm-to-Firm Trade

Alviarez Vanessa, Fioretti Michele, Kikkawa Ken et al.

Capital Market Performance and Macroeconomic Dynamics in Nigeria

Segun Michael Ojo, Oladapo Fapetu, Adekunle Alexander Balogun et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)