Summary

We develop a Functional Augmented Vector Autoregression (FunVAR) model to explicitly incorporate firm-level heterogeneity observed in more than one dimension and study its interaction with aggregate macroeconomic fluctuations. Our methodology employs dimensionality reduction techniques for tensor data objects to approximate the joint distribution of firm-level characteristics. More broadly, our framework can be used for assessing predictions from structural models that account for micro-level heterogeneity observed on multiple dimensions. Leveraging firm-level data from the Compustat database, we use the FunVAR model to analyze the propagation of total factor productivity (TFP) shocks, examining their impact on both macroeconomic aggregates and the cross-sectional distribution of capital and labor across firms.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper develops a Functional Augmented Vector Autoregression (FunVAR) model to explicitly incorporate firm-level heterogeneity observed in more than one dimension and study its interaction with aggregate macroeconomic fluctuations. The methodology employs dimensionality reduction techniques for tensor data objects to approximate the joint distribution of firm-level characteristics.

Key Results

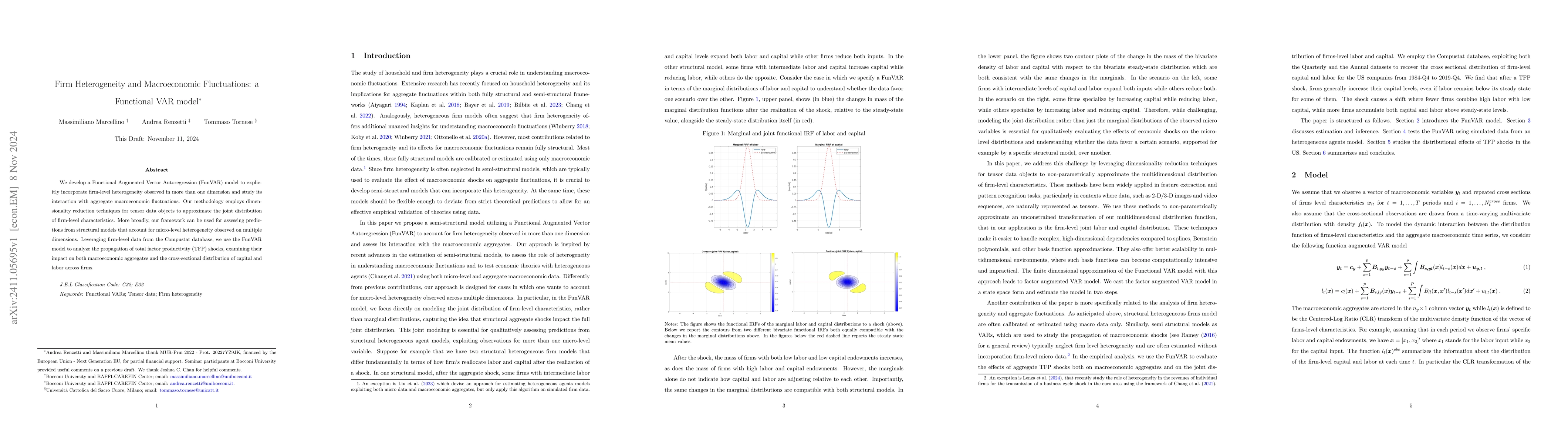

- The FunVAR model successfully captures the propagation of total factor productivity (TFP) shocks, examining their impact on both macroeconomic aggregates and the cross-sectional distribution of capital and labor across firms.

- Simulation results demonstrate that the FunVAR model can qualitatively replicate the effects of macroeconomic shocks on both the cross-sectional distributions and macroeconomic aggregates of a heterogeneous firm model.

- The model correctly recovers the dynamics of output, consumption, hours worked, investment, and wages after a TFP shock.

Significance

This research is important as it addresses the challenge of approximating a multidimensional distribution using data reduction techniques for tensor data objects, which is crucial for qualitatively assessing the effects of economic shocks on micro-level distributions and determining which scenario the data supports.

Technical Contribution

The paper introduces a Functional VAR model that explicitly incorporates firm-level heterogeneity observed in multiple dimensions, using dimensionality reduction techniques for tensor data objects to approximate the joint distribution of firm-level characteristics.

Novelty

This work is novel in its application of a Functional VAR model to study firm heterogeneity and its interaction with aggregate macroeconomic fluctuations, using dimensionality reduction techniques for tensor data objects to approximate the joint distribution of firm-level characteristics.

Limitations

- The FunVAR model is inherently misspecified as it approximates the joint distribution rather than marginal distributions, which could lead to discrepancies in certain scenarios.

- Accounting for flow variables in this framework would be more complicated due to the convolution of unobserved missing distributions.

Future Work

- Explore the incorporation of flow variables to enhance the model's applicability.

- Investigate the model's performance with different datasets and economic contexts.

Paper Details

PDF Preview

Similar Papers

Found 4 papersFirm Heterogeneity, Market Power and Macroeconomic Fragility

Alessandro Ferrari, Francisco Queirós

Inter-firm Heterogeneity in Production

Michele Battisti, Valentino Dardanoni, Stefano Demichelis

No citations found for this paper.

Comments (0)