Authors

Summary

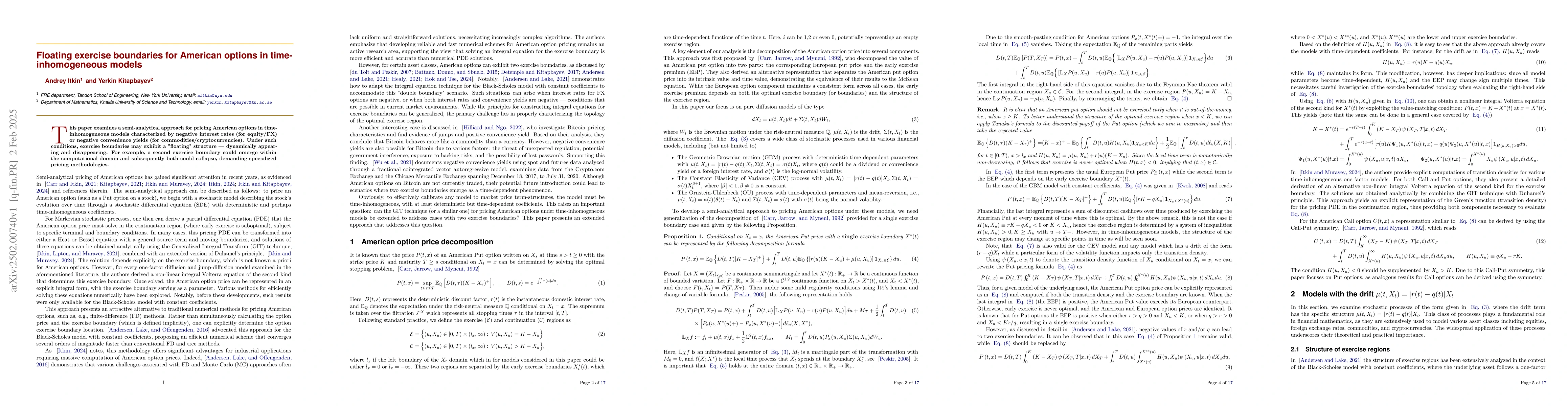

This paper examines a semi-analytical approach for pricing American options in time-inhomogeneous models characterized by negative interest rates (for equity, FX) or negative convenience yields (for commodities, cryptocurrencies). Under such conditions, exercise boundaries may exhibit a "floating" structure - dynamically appearing and disappearing. For example, a second exercise boundary could emerge within the computational domain and subsequently both could collapse, demanding specialized pricing methodologies.

AI Key Findings

Generated Jun 12, 2025

Methodology

The paper presents a semi-analytical approach for pricing American options in time-inhomogeneous models under negative interest rates or negative convenience yields, focusing on scenarios where exercise boundaries dynamically appear and disappear.

Key Results

- The study identifies 'floating' exercise boundaries for American options in time-inhomogeneous models with negative interest rates or yields.

- Specialized pricing methodologies are required due to the dynamic nature of exercise boundaries, which can appear and collapse within the computational domain.

- The paper extends the analysis to more general time-inhomogeneous models, providing a framework for handling complex scenarios with changing model parameters.

Significance

This research is significant for financial institutions dealing with assets under negative interest rates or yields, as it provides a method to accurately price American options in such challenging environments, improving risk management and pricing accuracy.

Technical Contribution

The paper's main technical contribution is the development of a semi-analytical method for pricing American options in time-inhomogeneous models, addressing the challenge of floating exercise boundaries.

Novelty

This work stands out by addressing the pricing of American options in time-inhomogeneous models under negative interest rates or yields, a gap in existing literature, and by introducing a flexible framework applicable to various model structures.

Limitations

- The approach assumes specific model structures and may not be directly applicable to all types of time-inhomogeneous models without modification.

- Computational complexity may increase with more intricate model parameters, potentially affecting practical implementation for real-time applications.

Future Work

- Further research could explore the application of this methodology to other asset classes and more complex financial derivatives.

- Investigating the impact of stochastic volatility on exercise boundaries could extend the current findings.

Paper Details

PDF Preview

Similar Papers

Found 4 papersPricing American Parisian Options under General Time-Inhomogeneous Markov Models

Yuhao Liu, Gongqiu Zhang, Nian Yang

No citations found for this paper.

Comments (0)