Summary

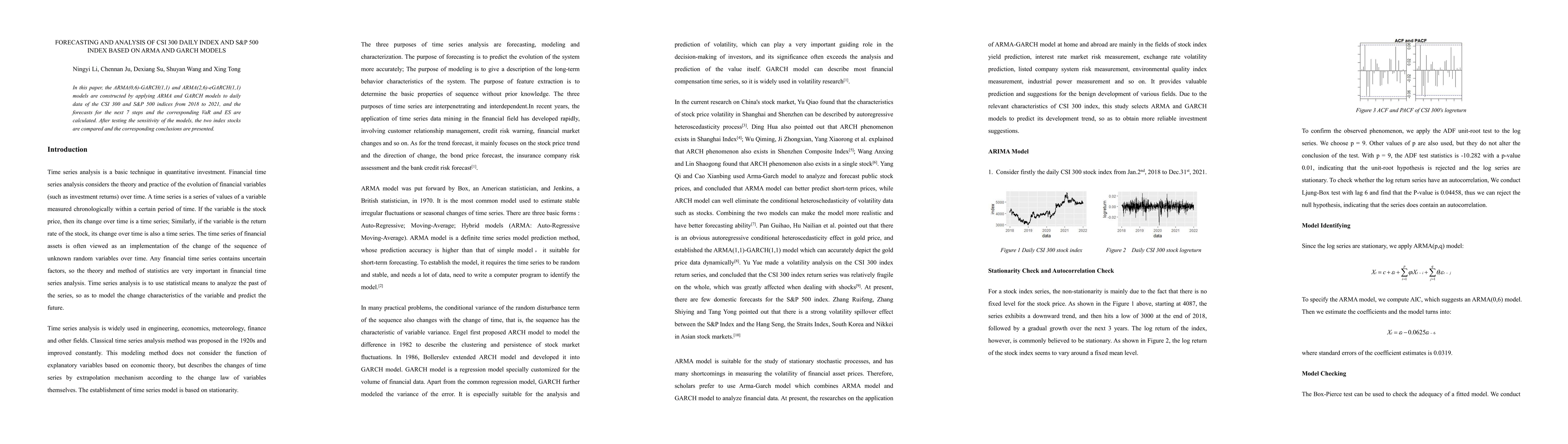

In this paper, the ARMA(0,6)-GARCH(1,1) and ARMA(2,6)-eGARCH(1,1) models are constructed by applying ARMA and GARCH models to daily data of the CSI 300 and S&P 500 indices from 2018 to 2021, and the forecasts for the next 7 steps and the corresponding VaR and ES are calculated. After testing the sensitivity of the models, the two index stocks are compared and the corresponding conclusions are presented.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersThe Hybrid Forecast of S&P 500 Volatility ensembled from VIX, GARCH and LSTM models

Natalia Roszyk, Robert Ślepaczuk

No citations found for this paper.

Comments (0)