Summary

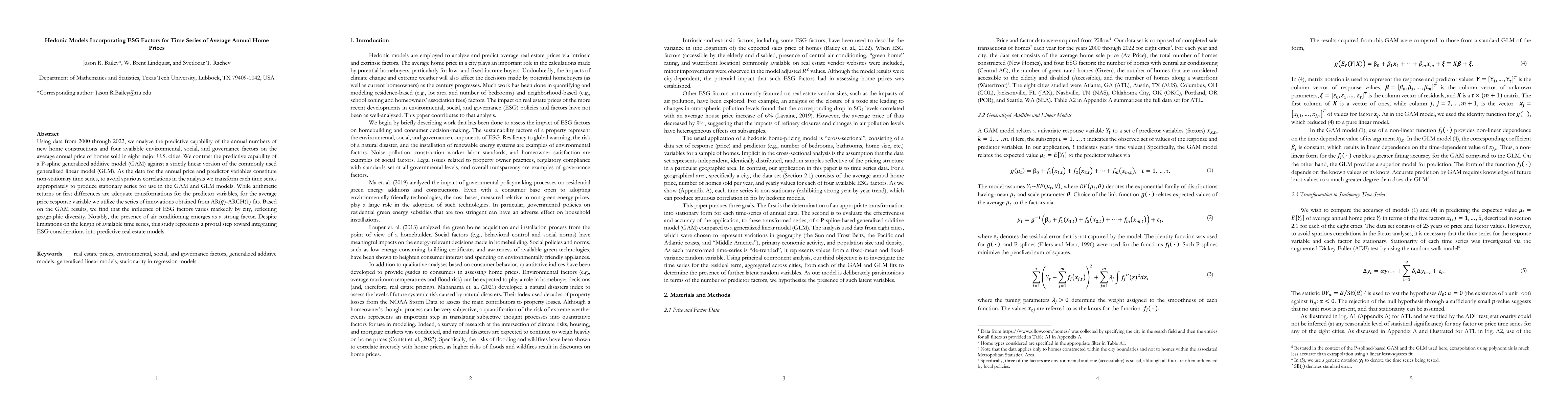

Using data from 2000 through 2022, we analyze the predictive capability of the annual numbers of new home constructions and four available environmental, social, and governance factors on the average annual price of homes sold in eight major U.S. cities. We contrast the predictive capability of a P-spline generalized additive model (GAM) against a strictly linear version of the commonly used generalized linear model (GLM). As the data for the annual price and predictor variables constitute non-stationary time series, to avoid spurious correlations in the analysis we transform each time series appropriately to produce stationary series for use in the GAM and GLM models. While arithmetic returns or first differences are adequate transformations for the predictor variables, for the average price response variable we utilize the series of innovations obtained from AR(q)-ARCH(1) fits. Based on the GAM results, we find that the influence of ESG factors varies markedly by city, reflecting geographic diversity. Notably, the presence of air conditioning emerges as a strong factor. Despite limitations on the length of available time series, this study represents a pivotal step toward integrating ESG considerations into predictive real estate models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHedonic Models of Real Estate Prices: GAM and Environmental Factors

W. Brent Lindquist, Svetlozar T. Rachev, Jason R. Bailey et al.

Hedonic Prices and Quality Adjusted Price Indices Powered by AI

Jin Wang, Junbo Li, Victor Chernozhukov et al.

No citations found for this paper.

Comments (0)