Authors

Summary

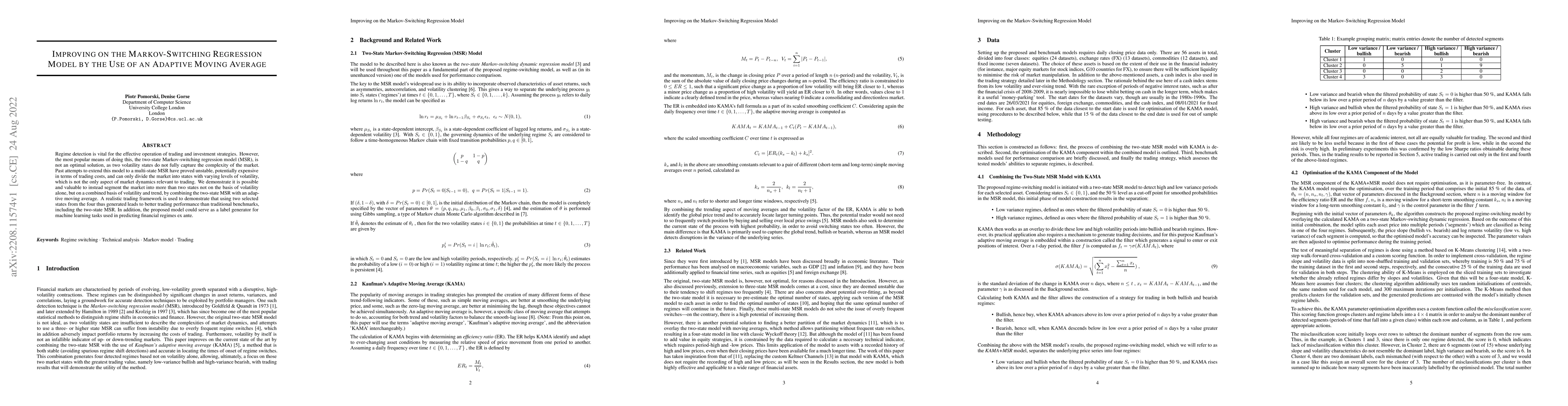

Regime detection is vital for the effective operation of trading and investment strategies. However, the most popular means of doing this, the two-state Markov-switching regression model (MSR), is not an optimal solution, as two volatility states do not fully capture the complexity of the market. Past attempts to extend this model to a multi-state MSR have proved unstable, potentially expensive in terms of trading costs, and can only divide the market into states with varying levels of volatility, which is not the only aspect of market dynamics relevant to trading. We demonstrate it is possible and valuable to instead segment the market into more than two states not on the basis of volatility alone, but on a combined basis of volatility and trend, by combining the two-state MSR with an adaptive moving average. A realistic trading framework is used to demonstrate that using two selected states from the four thus generated leads to better trading performance than traditional benchmarks, including the two-state MSR. In addition, the proposed model could serve as a label generator for machine learning tasks used in predicting financial regimes ex ante.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Adaptive Moving Average for Macroeconomic Monitoring

Philippe Goulet Coulombe, Karin Klieber

| Title | Authors | Year | Actions |

|---|

Comments (0)