Authors

Summary

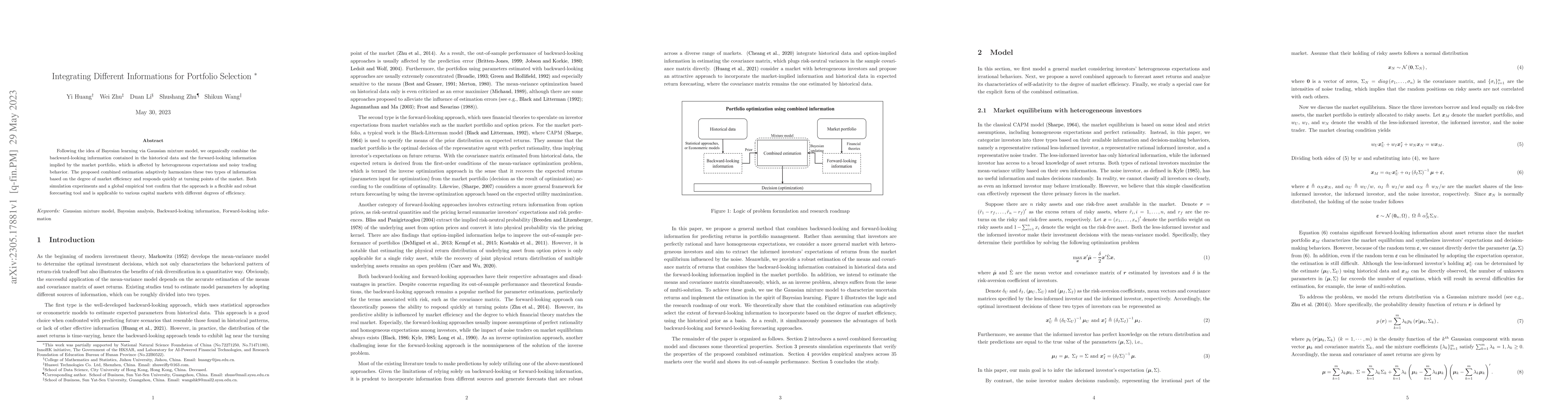

Following the idea of Bayesian learning via Gaussian mixture model, we organically combine the backward-looking information contained in the historical data and the forward-looking information implied by the market portfolio, which is affected by heterogeneous expectations and noisy trading behavior. The proposed combined estimation adaptively harmonizes these two types of information based on the degree of market efficiency and responds quickly at turning points of the market. Both simulation experiments and a global empirical test confirm that the approach is a flexible and robust forecasting tool and is applicable to various capital markets with different degrees of efficiency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeepClair: Utilizing Market Forecasts for Effective Portfolio Selection

Jinho Lee, Donghee Choi, Mogan Gim et al.

ChatGPT-based Investment Portfolio Selection

Oleksandr Romanko, Akhilesh Narayan, Roy H. Kwon

No citations found for this paper.

Comments (0)