Authors

Summary

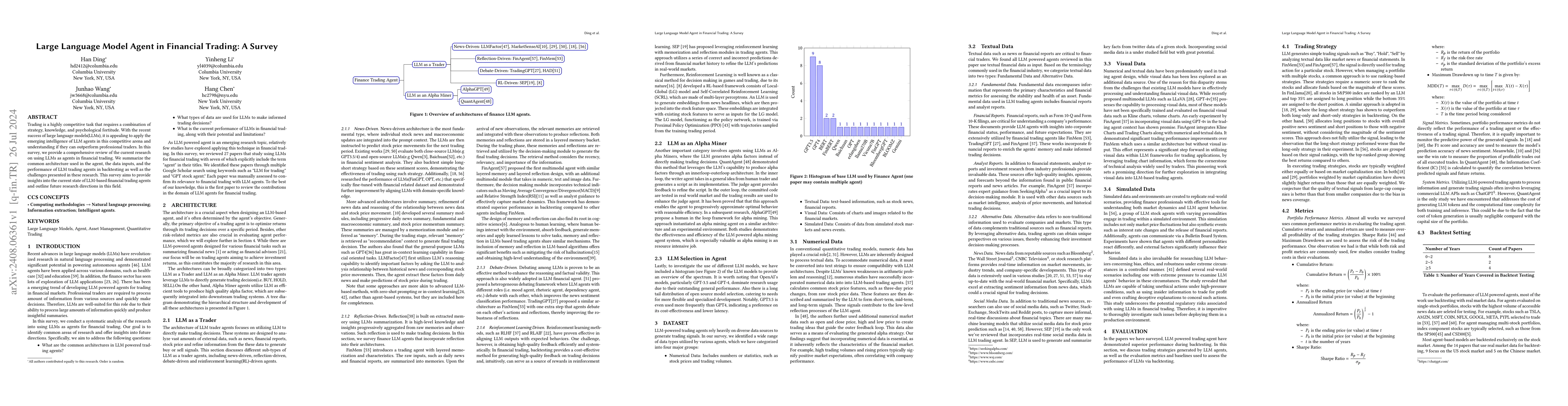

Trading is a highly competitive task that requires a combination of strategy, knowledge, and psychological fortitude. With the recent success of large language models(LLMs), it is appealing to apply the emerging intelligence of LLM agents in this competitive arena and understanding if they can outperform professional traders. In this survey, we provide a comprehensive review of the current research on using LLMs as agents in financial trading. We summarize the common architecture used in the agent, the data inputs, and the performance of LLM trading agents in backtesting as well as the challenges presented in these research. This survey aims to provide insights into the current state of LLM-based financial trading agents and outline future research directions in this field.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntegrating Large Language Models in Financial Investments and Market Analysis: A Survey

Chen, Sedigheh Mahdavi, Jiating et al.

HedgeAgents: A Balanced-aware Multi-agent Financial Trading System

Xiangmin Xu, Jin Xu, Yawen Zeng et al.

A Multimodal Foundation Agent for Financial Trading: Tool-Augmented, Diversified, and Generalist

Wentao Zhang, Shuo Sun, Xinyi Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)