Summary

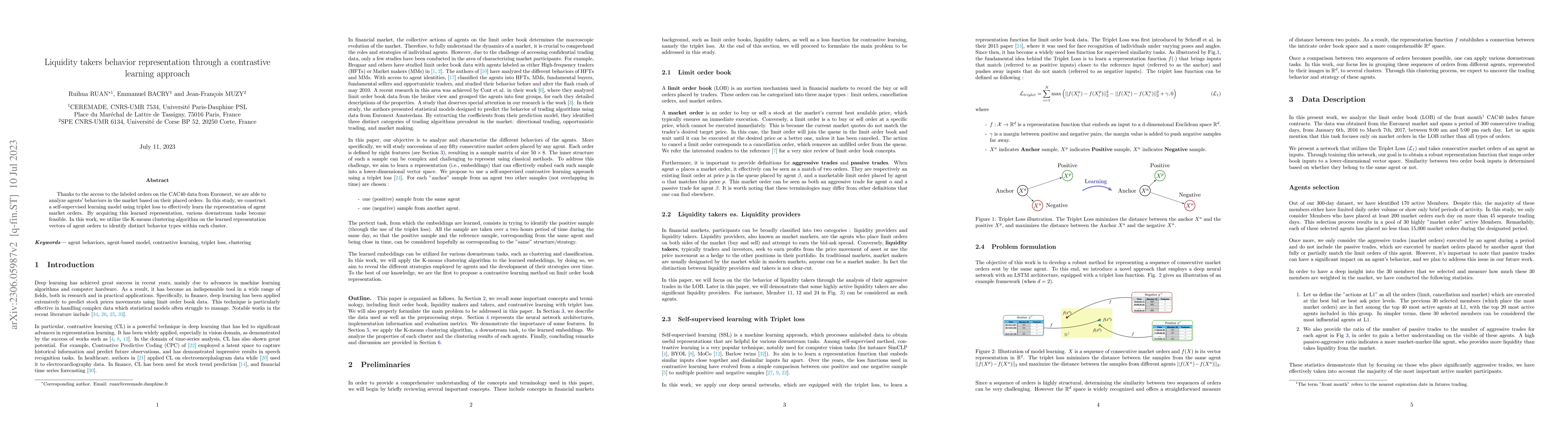

Thanks to the access to the labeled orders on the CAC40 data from Euronext, we are able to analyze agents' behaviors in the market based on their placed orders. In this study, we construct a self-supervised learning model using triplet loss to effectively learn the representation of agent market orders. By acquiring this learned representation, various downstream tasks become feasible. In this work, we utilize the K-means clustering algorithm on the learned representation vectors of agent orders to identify distinct behavior types within each cluster.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersContrastive Network Representation Learning

Lexin Li, Xin Zhou, Linjun Zhang et al.

Learning Robust Representation through Graph Adversarial Contrastive Learning

Yan Zhang, Yue Zhao, Jiayan Guo et al.

Revealing Multimodal Contrastive Representation Learning through Latent Partial Causal Models

Anton van den Hengel, Biwei Huang, Kun Zhang et al.

Masked Contrastive Representation Learning

Marimuthu Palaniswami, Yuchong Yao, Nandakishor Desai

No citations found for this paper.

Comments (0)