Summary

We introduce a class of measure-valued processes, which -- in analogy to their finite dimensional counterparts -- will be called measure-valued polynomial diffusions. We show the so-called moment formula, i.e.~a representation of the conditional marginal moments via a system of finite dimensional linear PDEs. Furthermore, we characterize the corresponding infinitesimal generators and obtain a representation analogous to polynomial diffusions on $\mathbb{R}^m_+$, in cases where their domain is large enough. In general the infinite dimensional setting allows for richer specifications strictly beyond this representation. As a special case we recover measure-valued affine diffusions, sometimes also called Dawson-Watanabe superprocesses. From a mathematical finance point of view the polynomial framework is especially attractive as it allows to transfer the most famous finite dimensional models, such as the Black-Scholes model, to an infinite dimensional measure-valued setting. We outline in particular the applicability of our approach for term structure modeling in energy markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

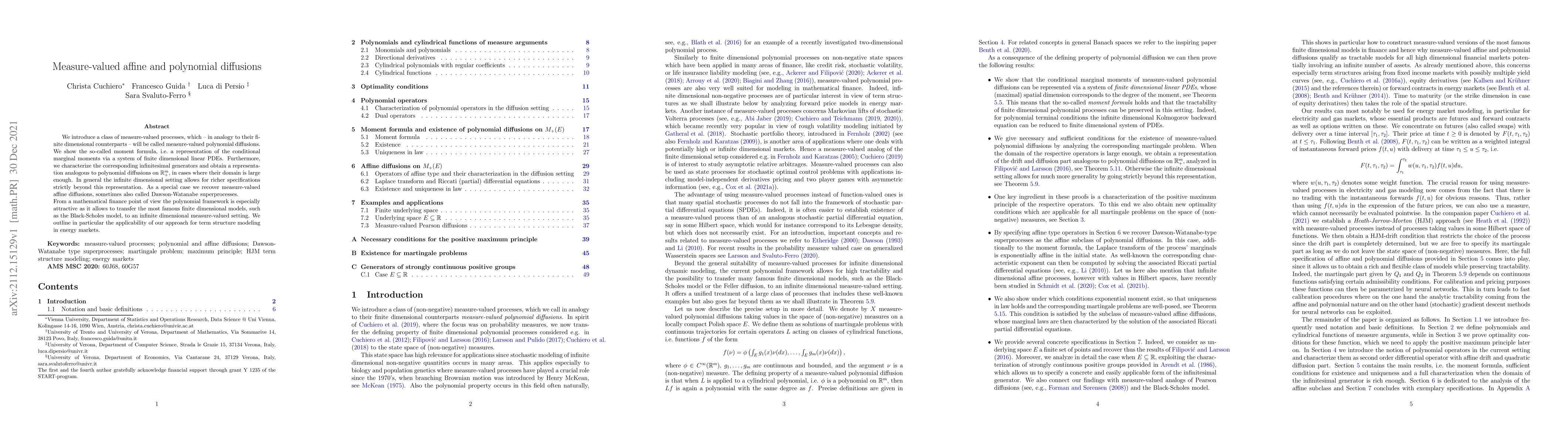

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMeasure-valued processes for energy markets

Luca Di Persio, Christa Cuchiero, Sara Svaluto-Ferro et al.

A two-parameter family of measure-valued diffusions with Poisson-Dirichlet stationary distributions

Quan Shi, Douglas Rizzolo, Noah Forman et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)