Summary

We introduce a framework that allows to employ (non-negative) measure-valued processes for energy market modeling, in particular for electricity and gas futures. Interpreting the process' spatial structure as time to maturity, we show how the Heath-Jarrow-Morton approach can be translated to this framework, thus guaranteeing arbitrage free modeling in infinite dimensions. We derive an analog to the HJM-drift condition and then treat in a Markovian setting existence of non-negative measure-valued diffusions that satisfy this condition. To analyze mathematically convenient classes we build on Cuchiero et al. (2021) and consider measure-valued polynomial and affine diffusions, where we can precisely specify the diffusion part in terms of continuous functions satisfying certain admissibility conditions. For calibration purposes these functions can then be parameterized by neural networks yielding measure-valued analogs of neural SPDEs. By combining Fourier approaches or the moment formula with stochastic gradient descent methods, this then allows for tractable calibration procedures which we also test by way of example on market data. We also sketch how measure-valued processes can be applied in the context of renewable energy production modeling.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

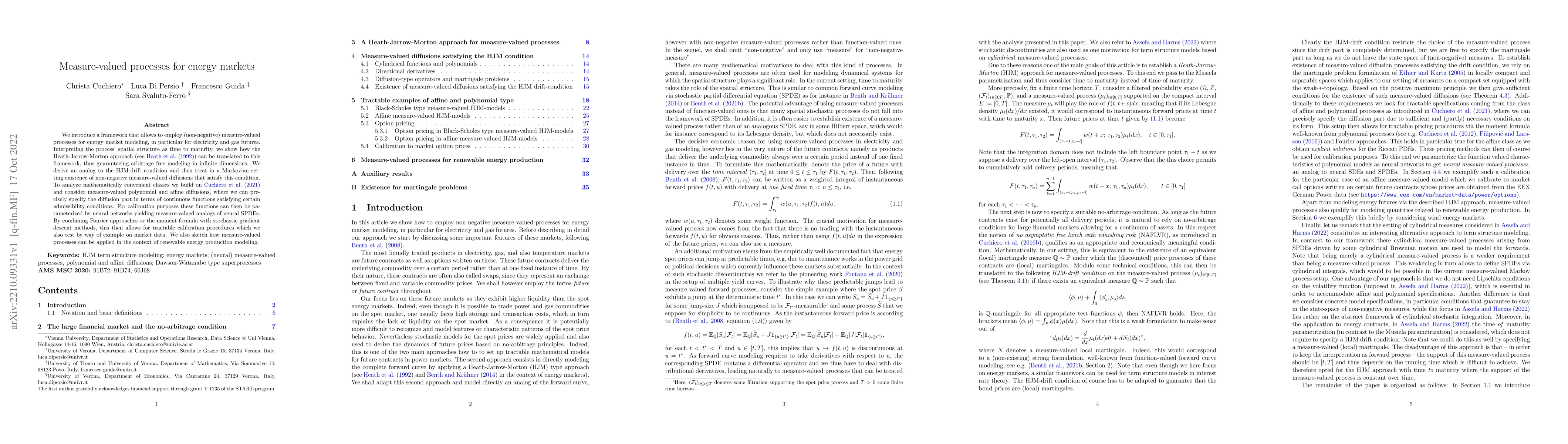

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)