Summary

This article investigates the causality structure of financial time series. We concentrate on three main approaches to measuring causality: linear Granger causality, kernel generalisations of Granger causality (based on ridge regression and the Hilbert--Schmidt norm of the cross-covariance operator) and transfer entropy, examining each method and comparing their theoretical properties, with special attention given to the ability to capture nonlinear causality. We also present the theoretical benefits of applying non-symmetrical measures rather than symmetrical measures of dependence. We apply the measures to a range of simulated and real data. The simulated data sets were generated with linear and several types of nonlinear dependence, using bivariate, as well as multivariate settings. An application to real-world financial data highlights the practical difficulties, as well as the potential of the methods. We use two real data sets: (1) U.S. inflation and one-month Libor; (2) S$\&$P data and exchange rates for the following currencies: AUDJPY, CADJPY, NZDJPY, AUDCHF, CADCHF, NZDCHF. Overall, we reach the conclusion that no single method can be recognised as the best in all circumstances, and each of the methods has its domain of best applicability. We also highlight areas for improvement and future research.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

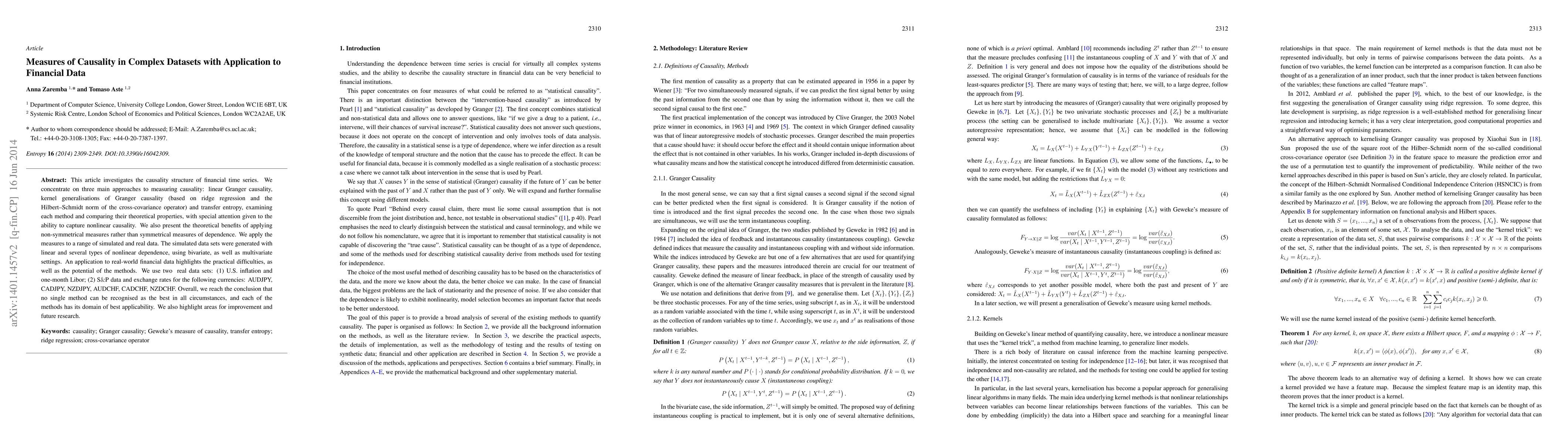

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLinear and nonlinear causality in financial markets

Christoph Räth, Haochun Ma, Davide Prosperino et al.

A Generative Approach for Financial Causality Extraction

Pawan Goyal, Niloy Ganguly, Koustuv Dasgupta et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)