Summary

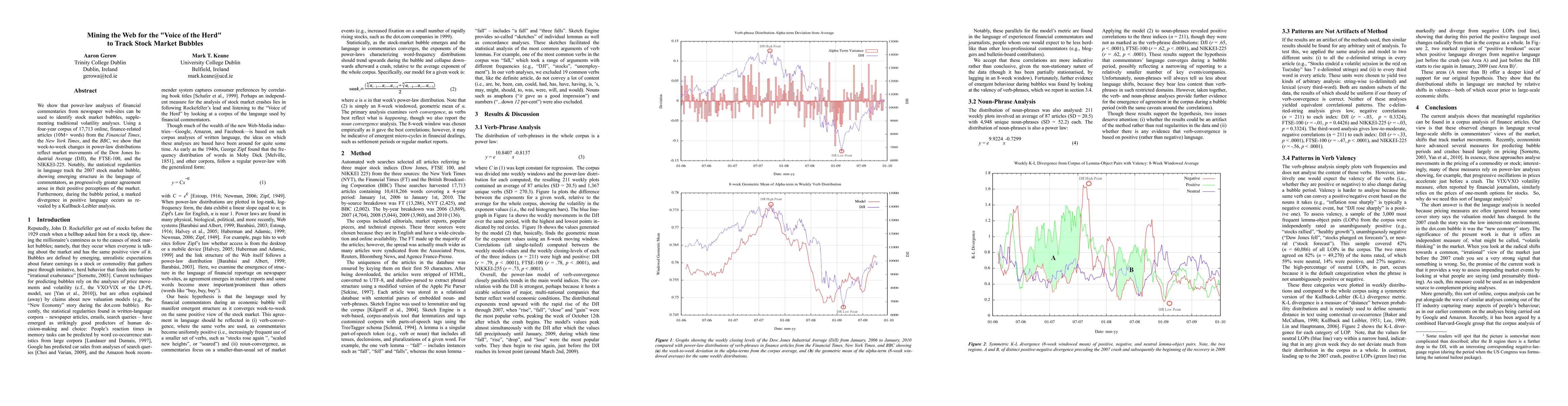

We show that power-law analyses of financial commentaries from newspaper web-sites can be used to identify stock market bubbles, supplementing traditional volatility analyses. Using a four-year corpus of 17,713 online, finance-related articles (10M+ words) from the Financial Times, the New York Times, and the BBC, we show that week-to-week changes in power-law distributions reflect market movements of the Dow Jones Industrial Average (DJI), the FTSE-100, and the NIKKEI-225. Notably, the statistical regularities in language track the 2007 stock market bubble, showing emerging structure in the language of commentators, as progressively greater agreement arose in their positive perceptions of the market. Furthermore, during the bubble period, a marked divergence in positive language occurs as revealed by a Kullback-Leibler analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)